It was more of the same as the week before for natural gas report week, December 9, 2021. With production steady, demand largely unchanged, and temperature forecasts looking more like spring than winter, the market remained ambivalent even as international prices pressed record highs.

Can we reasonably anticipate the highest of this season’s natural gas prices are behind us? Last week’s release of the EIA Short Term Energy Outlook gave some hints.

This week, we’ll look at the highlights.

Natural Gas

Early withdrawal season warm weather eased market apprehension over the possibility of supply shortages driven by winter cold. With nearly half of the trading months in withdrawal season behind us and forecasts for above-average temperatures expected through the end of December, projected moderate heating demand is expected to contribute to small weekly withdrawals which will ultimately bring storage totals within the five-year average.

As such, the EIA reduced their Henry Hub spot price outlook through February 2022 from an average of $5.24/MMBtu in the November STEO to $4.85/MMBtu in the December report. Of course, that comes with a caveat: expect volatility in temperatures to translate to temporary price spikes.

Looking beyond winter, the EIA expects prices will average $3.98/MMBtu throughout 2022 compliments of increasing production.

Crude Oil

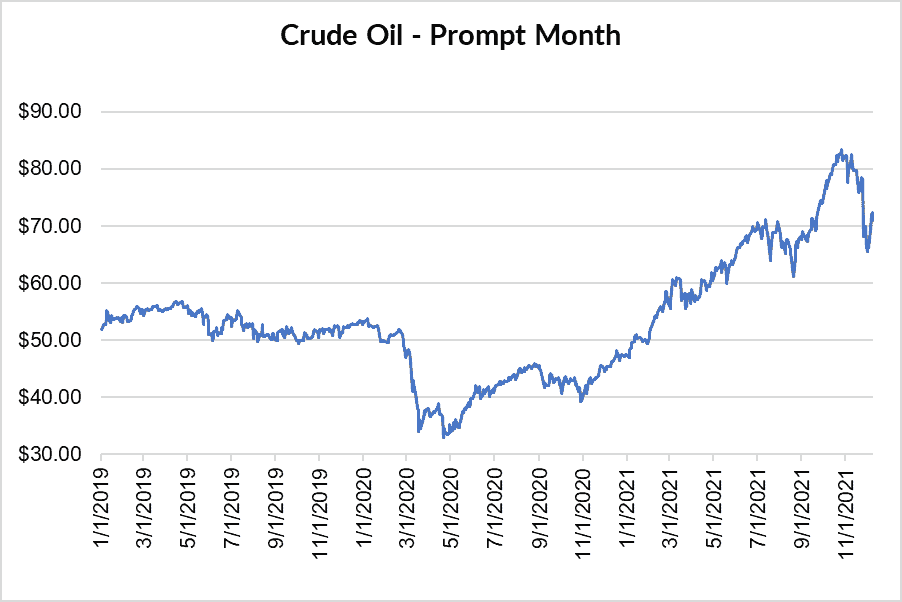

On November 26th, crude oil prices collapsed, dropping $9.50 per barrel while the global economy digested news of the latest COVID variant. Later that week, prices rebounded even after OPEC re-upped an earlier commitment to increase production by 400,000 barrels a day beginning in January.

Prices remained stable, aligned with EIA forecasts for $71/b on average throughout December 2021. Analysts expect prices to remain steady at $73/b throughout the 1Q 2022 which is anticipated to incentivize production and translate to increased associated gas capture.

Natural Gas Futures Quick Look

FEB22, settled at $3.784/Dth, down 21.3 cents

MAR22, settled at $3.686/Dth down 16.0 cents

APR22, settled at $3.624/Dth down 5.2 cents

MAY22, settled at $3.638/Dth down 1.5 cents

JUN22, settled at $3.684/Dth down less than a penny

Natural Gas Market Report – December 9, 2021

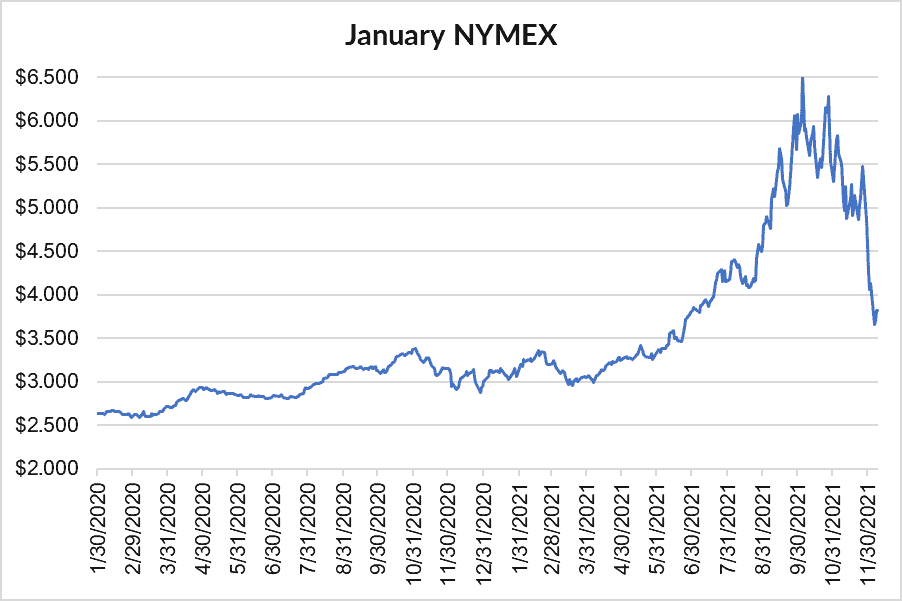

January NYMEX

Settled Thursday at $3.814/Dth down less than a penny from Wednesday’s close at $3.815/Dth.

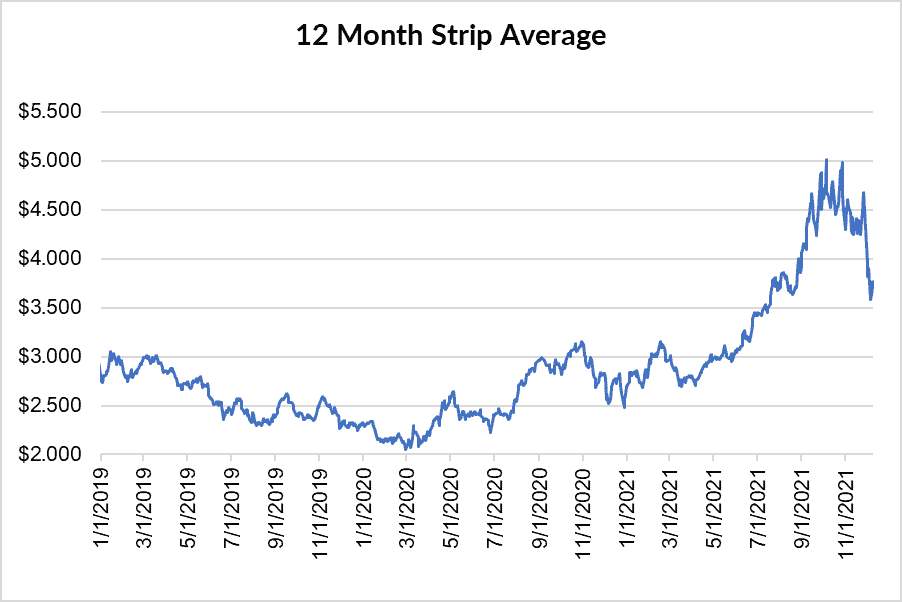

12 Month Strip

Settled Thursday at $3.768/Dth, down 5.3 cents from the prior week.

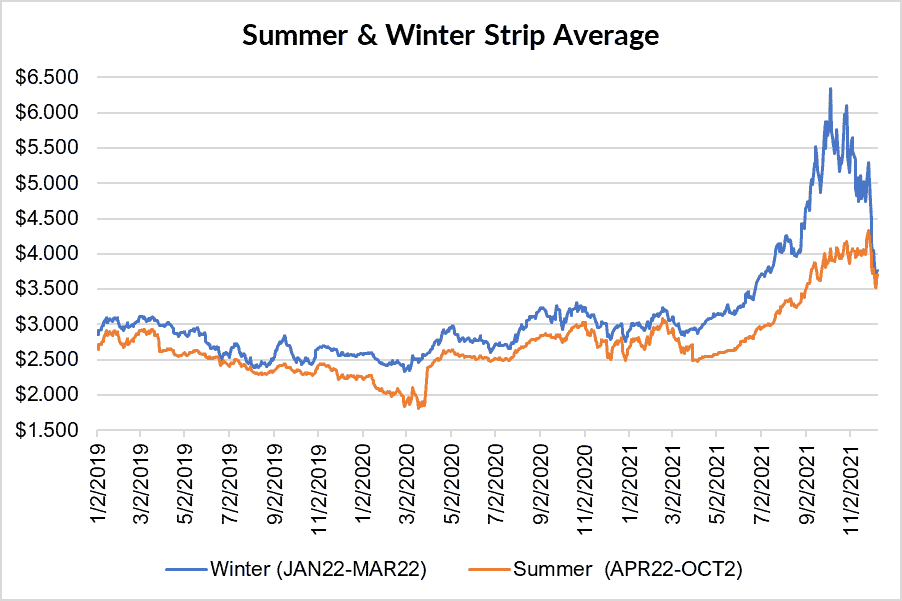

Seasonal Strips

The winter strip (JAN22-MAR22) settled Thursday at $3.761/Dth, down 20.5 cents from the week prior. The summer strip (APR22-OCT22) settled Thursday at $3.709/Dth, down a penny from the week prior.

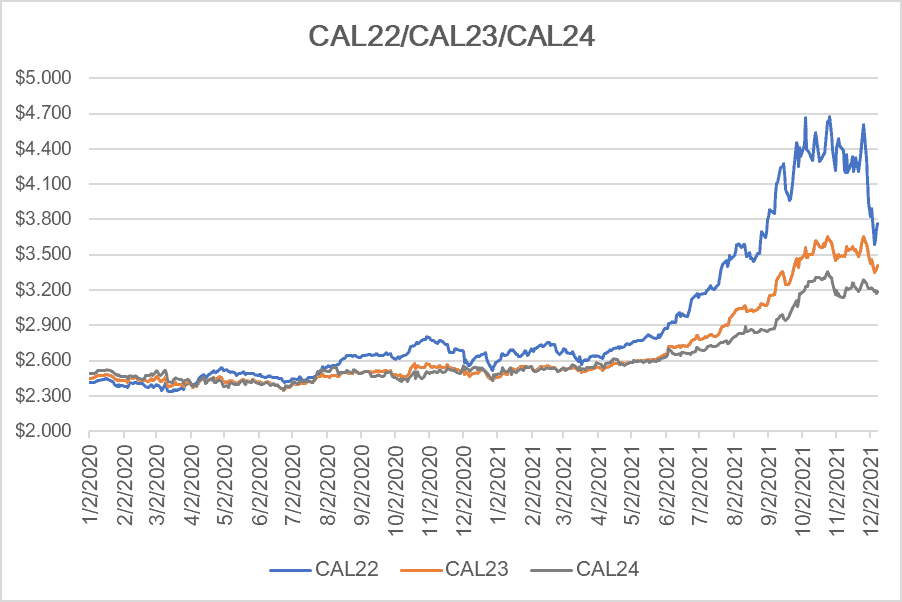

Calendar Years 2022/2023/2024

CY22 settled Thursday at $3.768/Dth, down 5.3 cents from the prior week.

CY23 settled Thursday at $3.411/Dth, down 1.7 cents from the prior week.

CY24 settled Thursday at $3.188/Dth, down 2.2 cents from the prior week.

Crude Oil

Settled Thursday at $70.94/barrel, up $4.44 from the prior week.

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.