Natural Gas Weekly – July 14, 2022

Natural Gas – Week In Review

Natural gas report week, July 14, 2022.

This week’s injection of 58 Bcf was in line with analysts’ expectations which ranged from 43 Bcf to 69 Bcf. Comparatively, last year’s injection was 49 Bcf and the five-year average of net injections is 55 Bcf. Current storage totals 2,369 Bcf which is 11.9% below the five-year average but still within the five-year historical range.

With above-average temperatures expected for the next two weeks and increased reliance on natural gas used for power generation, it’s likely the upward price trend from this week will continue. Beyond the near-term forecast, this week we’ll look at how other factors may line up to impact prices this winter.

Natural Gas Weekly Fundamentals

Demand- Total demand up 1.8 Bcf/d from last week, due, in part, to a 2.0 Bcf/d increase in cooling-related demand. LNG export ships add four, totaling 23 on the week for an overall capacity of 84 Bcf, up 13 Bcf from last week.

Production – Production unimpressive, dropping 0.5 Bcf from last week with imports from Canada offsetting production losses, up 0.4 Bcf/d.

Storage Forecast – The average rate of injections into storage is 4% lower than the five-year average at this point in refill season (which traditionally runs April through October). If the injection rate matches the five-year average of 8.3 Bcf/d through October 31, natural gas supply will total 3,323 Bcf, 319 Bcf lower than the five-year average of 3,645 Bcf.

Natural Gas Outlook

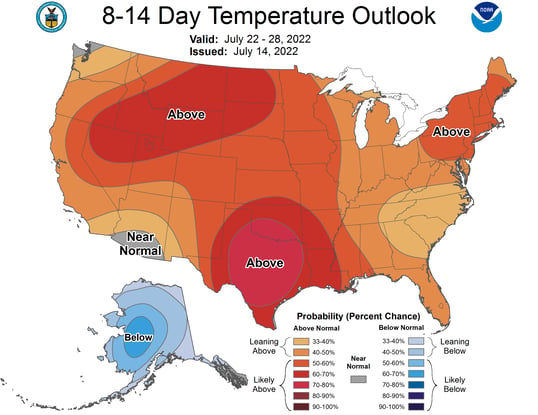

NOAA’s 8-14 outlook shows above-average temperatures for almost all the country. Expect this to push power generation demand higher as cooling consumption grows. In addition to higher temperatures, drought in the western United States has threated to significantly reduce hydroelectricity’s contribution to the power generation mix, adding to increased reliance on natural gas.

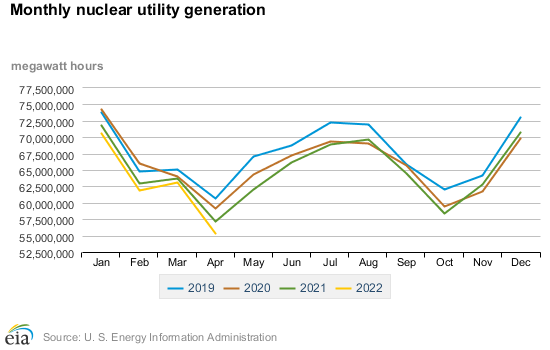

And for the trifecta, nuclear generation has declined substantially since 2019. This trend is expected to continue as existing generators continue to retire.

For those of you keeping track, as far as power generation is concerned, fossil fuels such as coal (also on the decline) and renewables represent the rest of the power generation mix. If fossil fuel use is diminishing, renewables must grow at a rate that will offset all other losses. Without that, demand for natural gas used in power generation will remain high.

When Freeport returns to service (projected for the end of the year) unless production picks up sufficiently (which is unlikely), that will collide with an already tight supply-demand balance and anemic storage levels. The greater our proximity to winter heating season, the more significant impact this will have on winter prices.

If you don’t have a plan in place to minimize your exposure to price volatility, now’s the time.

Natural Gas Market Report – July 14, 2022

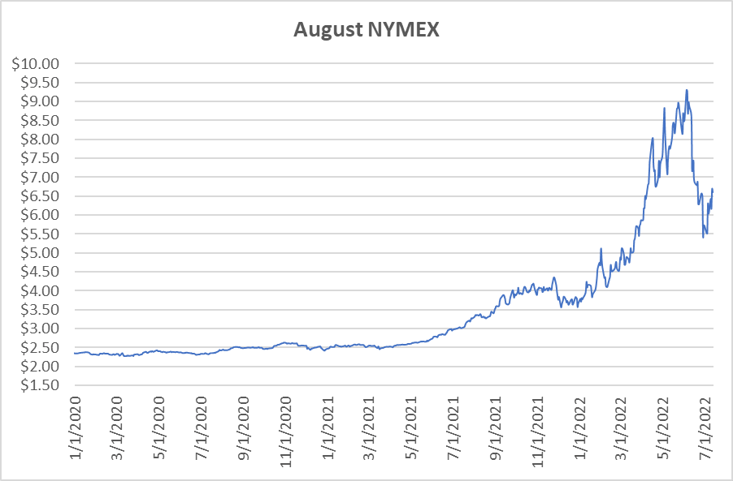

August NYMEX

August settled Thursday at $6.600/Dth, down 8.9 cents from Wednesday’s close at $6.689/Dth and up 30.3 cents over the prior week.

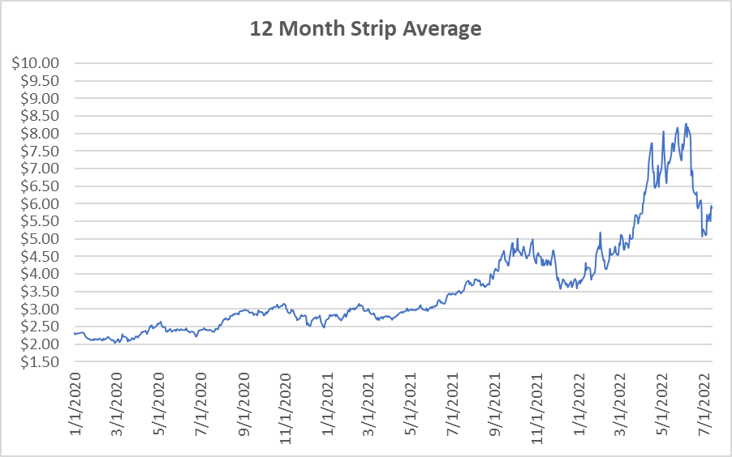

12 Month Strip

Settled Thursday at $5.876/Dth, up 19.4 cents from the prior week.

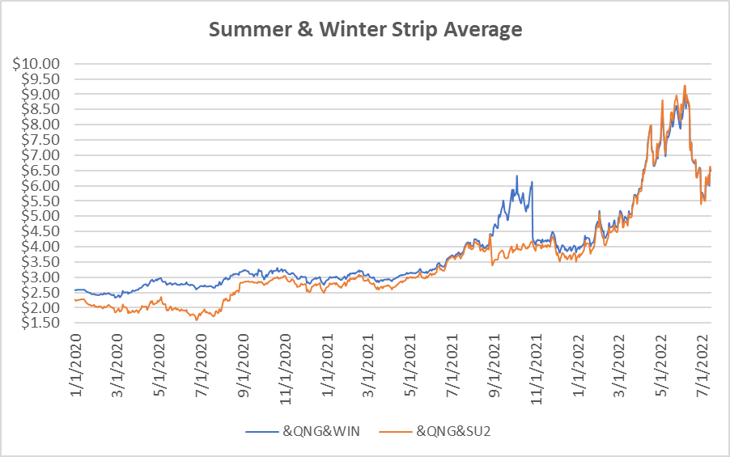

Seasonal Strips

The summer strip (AUG22-OCT22) settled at $6.538/Dth, up 26.7 cents from the week prior. The winter forward (NOV22-MAR23) settled Thursday at $6.480/Dth, up 23.2 cents from the week prior.

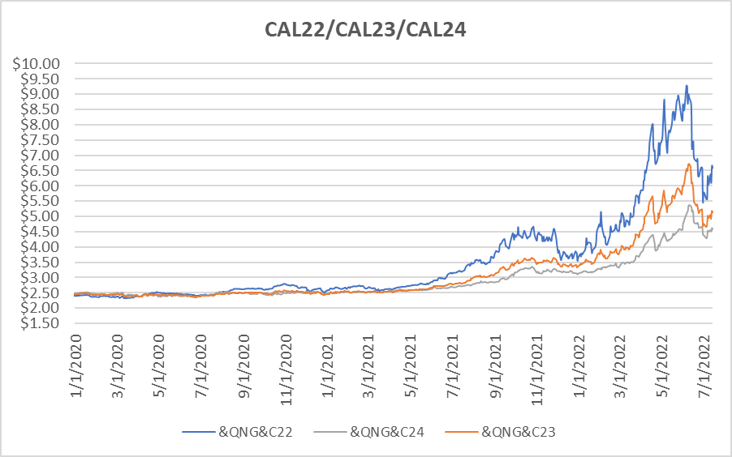

Calendar Years 2022/2023/2024

CY22 settled Thursday at $6.589/Dth, up 26.5 cents from the prior week.

CY23 settled Thursday at $5.143/Dth, up 12.0 cents from the prior week.

CY24 settled Thursday at $4.577/Dth, up 4.6 cents from the prior week.

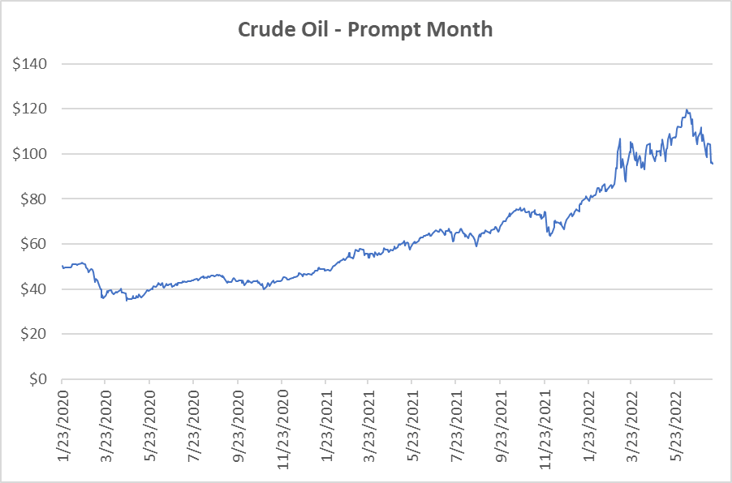

Crude Oil

Settled Thursday at $95.78/barrel, down $6.95 from the prior week.

Need Help Making Sense of Natural Gas Prices?

We can help you manage risk and navigate the current price volatility. We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.