Natural gas report week, May 26 2022.

This week’s injection of 80 Bcf was at the low end of analysts’ expectations which ranged from 76-103 Bcf. Despite a slight drop in production over last week and increases in both heating-related consumption and LNG demand, storage has continued a slow crawl out of its deficit to the five-year average.

June trading moved off the books Thursday, May 26th, settling the month at $8.908/Dth. In comparison, June 2021 settled at $2.984/Dth. If you’re inclined to think we’ve seen the ceiling, consider in 2008, June settled at $11.916/Dth and July followed up at $13.105/Dth.

As the supply/demand balance remains tight and the hottest weather of the season, thus far, is forecast for the northeastern half of the country next week, it’s reasonable to expect continued volatility.

Natural Gas Market Report – May 26, 2022

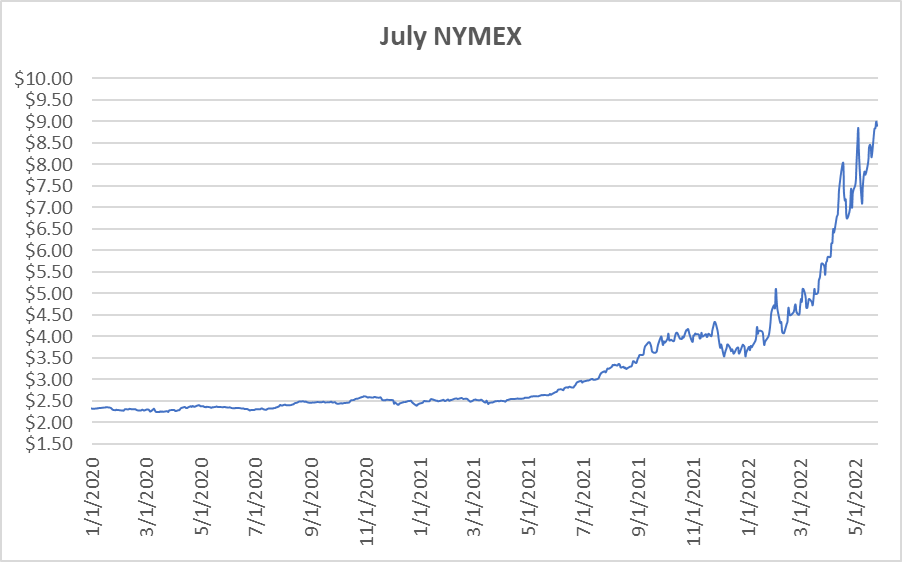

July NYMEX

June moved off the board Thursday, May 26th, settling the month at $8.908/Dth.

July settled Thursday at $8.895/Dth, down 9.8 cents from Wednesday’s close at $8.993/Dth, but up 49.5 cents over the prior week.

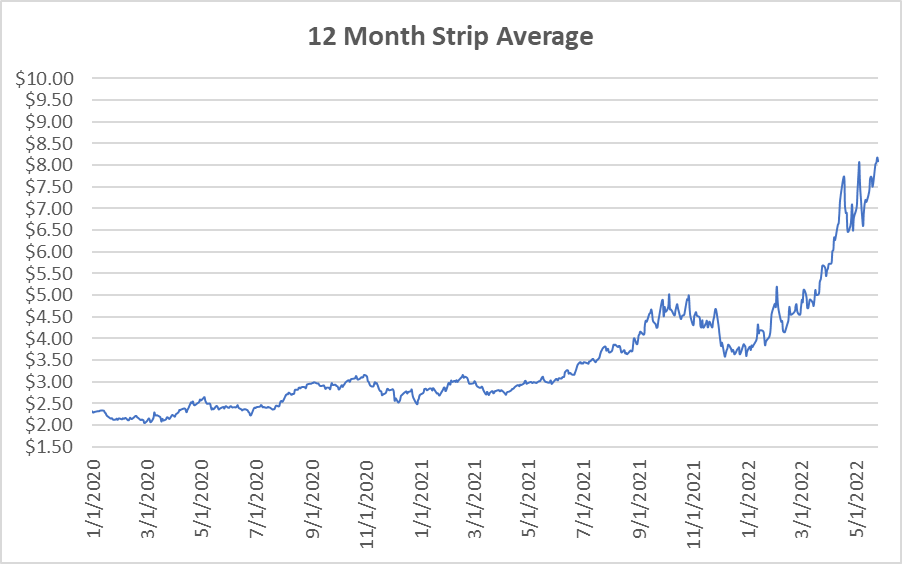

12 Month Strip

Settled Thursday at $8.082/Dth, up 40.0 cents from the prior week.

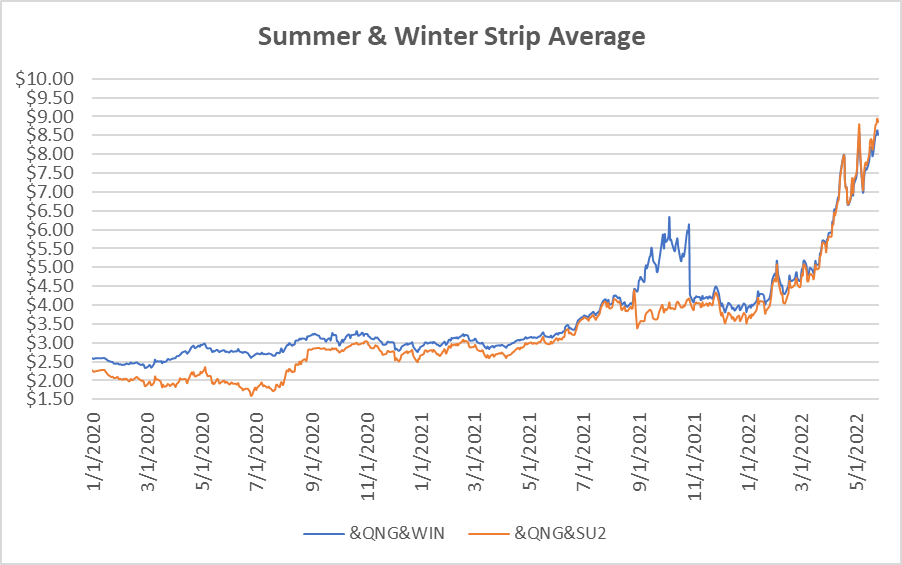

Seasonal Strips

The summer strip (JUL22-OCT22) settled at $8.864/Dth, up 50.9 cents from the week prior. The winter forward (NOV22-MAR23) settled Thursday at $8.503/Dth, up 36.4 cents from the week prior.

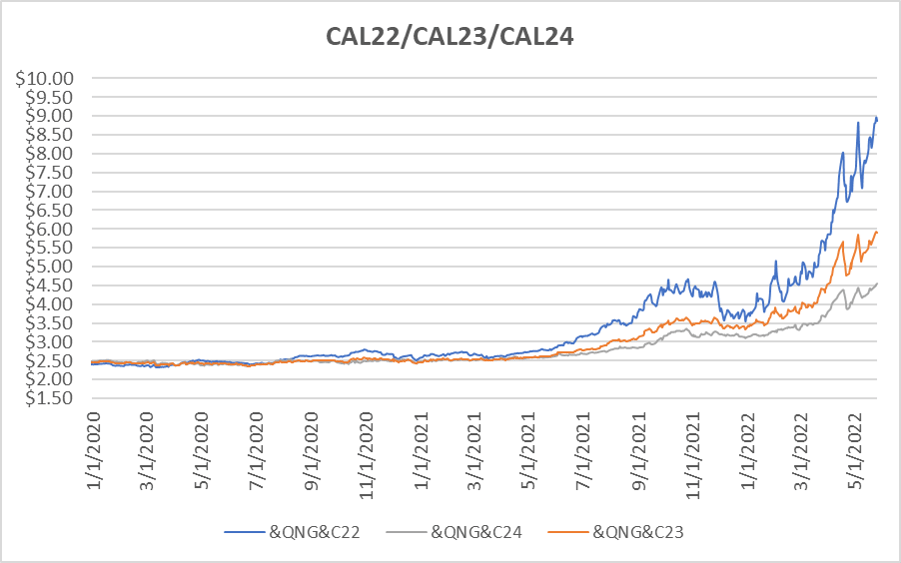

Calendar Years 2022/2023/2024

CY22 settled Thursday at $8.866/Dth, up 48.4 cents from the prior week.

CY23 settled Thursday at $5.902/Dth, up 23.9 cents from the prior week.

CY24 settled Thursday at $4.564/Dth, up 17.6 cents from the prior week.

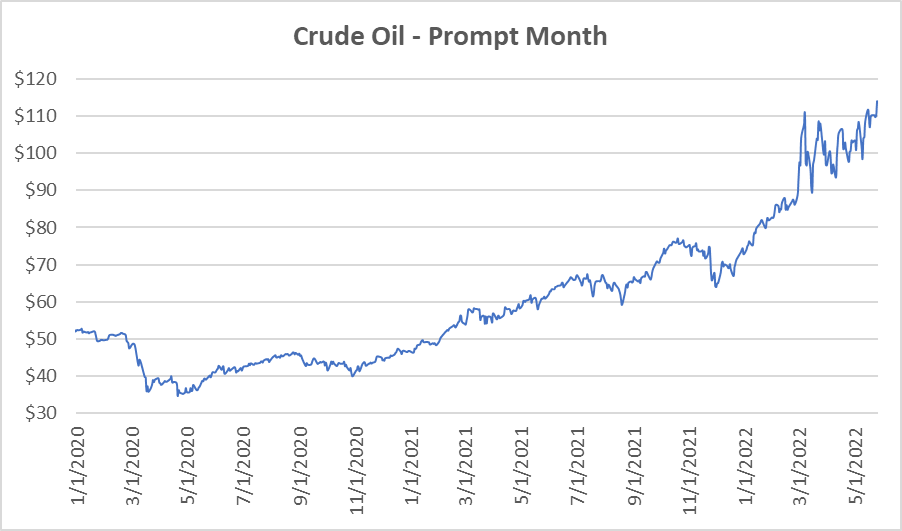

Crude Oil

Settled Thursday at $114.09/barrel, up $4.20 from the prior week.

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.

.png)