Throughout natural gas report week, November 18, 2021, prices continued to slide amid another post-injection season build, yielding a 26 Bcf addition to storage. The bearish market response persisted despite a week-over-week 11.8% (2.9 Bcf/d) increase in heating demand alongside a 1.1 Bcf/d drop in production.

However, international prices are on the rise again on renewed concerns over supply shortages. When this occurred in October, domestic prices also skyrocketed. Is this a sign for long-term price forecasts?

Let’s take a closer look…

UK/European Supply Shortages Drive Prices Higher

As a quick recap, earlier this fall, reports drew attention to the potential for a European energy crisis centering on historically low storage amounts. Prices surged as a result. Then Russia stepped in, promising increased natural gas deliveries which temporarily appeased those concerned it may be a brutal winter. But last week, it started to look like Russia will default on that promise.

This week, that eventuality became more certain and definitively more long-term as Germany suspended approval for the Nord Stream 2, a major pipeline from Russia. According to a report from Reuters, the start of the pipeline could be delayed until March 2022, which has, “raised fears that Europe, which gets a third of its gas from Russia, could face power outages due to low supplies.

European and UK prices have already spiked in response. Absent a change in these recent developments, that trend is likely to continue and if domestic prices mirror their October response, higher prices at home are on the horizon.

JAN22, settled at $4.995/Dth, down 25.0 cents

FEB22, settled at $4.904/Dth, down 21.2 cents

MAR22, settled at $4.671/Dth down 13.1 cents

APR22, settled at $4.019/Dth down 8.5 cents

MAY22, settled at $3.953/Dth down 7.1 cents

JUN22, settled at $3.982/Dth down 6.9 cents

A Learning Opportunity: The Future of Buying Energy For Your Business

We’re excited to share a new resource with you – one that’s founded on the belief that renewable energy should be easy for business decisionmakers to understand and implement. We want to help you get in front of the changes coming to the energy industry – beginning with education and planning.

Learn from energy industry experts as they identify renewable solutions for businesses of all sizes, discuss options for buying, weigh the benefits, and outline the practical steps you can take to make it happen for your business.

- How to Finance Renewable Energy Projects

- How to Present an Energy Project to Your Management Team

- Carbon Reporting: Why and How

Renewable energy is quickly becoming a significant issue confronting businesses so it’s important to begin proactive planning today. This virtual conference is a simple step in getting started.

For more information and to register, visit https://www.energycoalitionohio.org/oec

Natural Gas Market Report – November 18, 2021

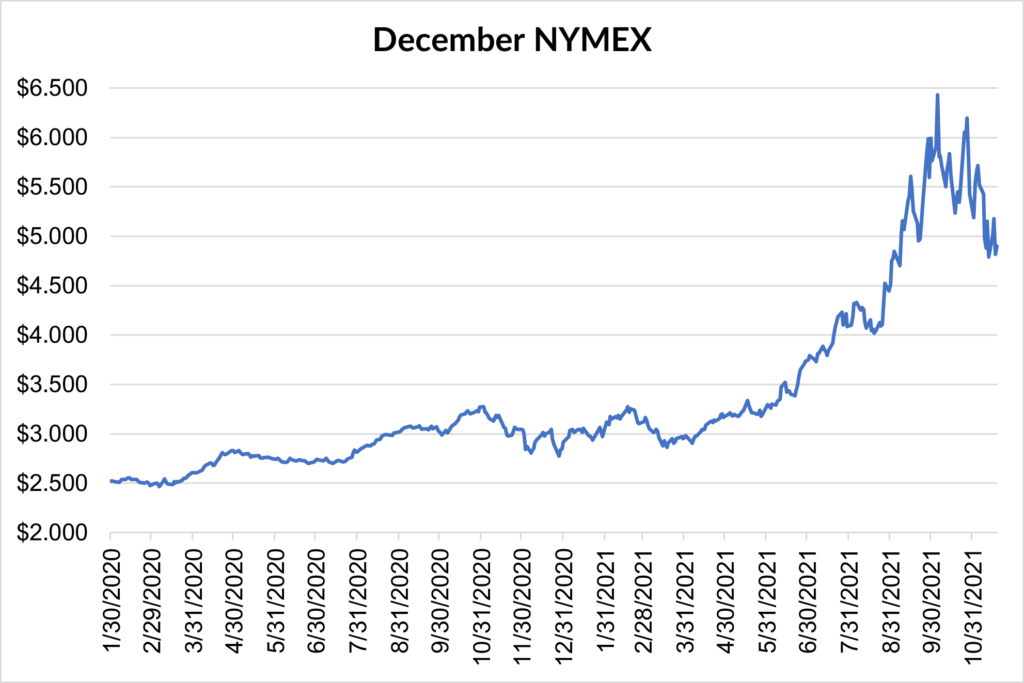

December NYMEX

December settled Thursday at $4.902/Dth up 8.6 cents from Wednesday’s close at $4.816/Dth, but down 24.7 cents week over week.

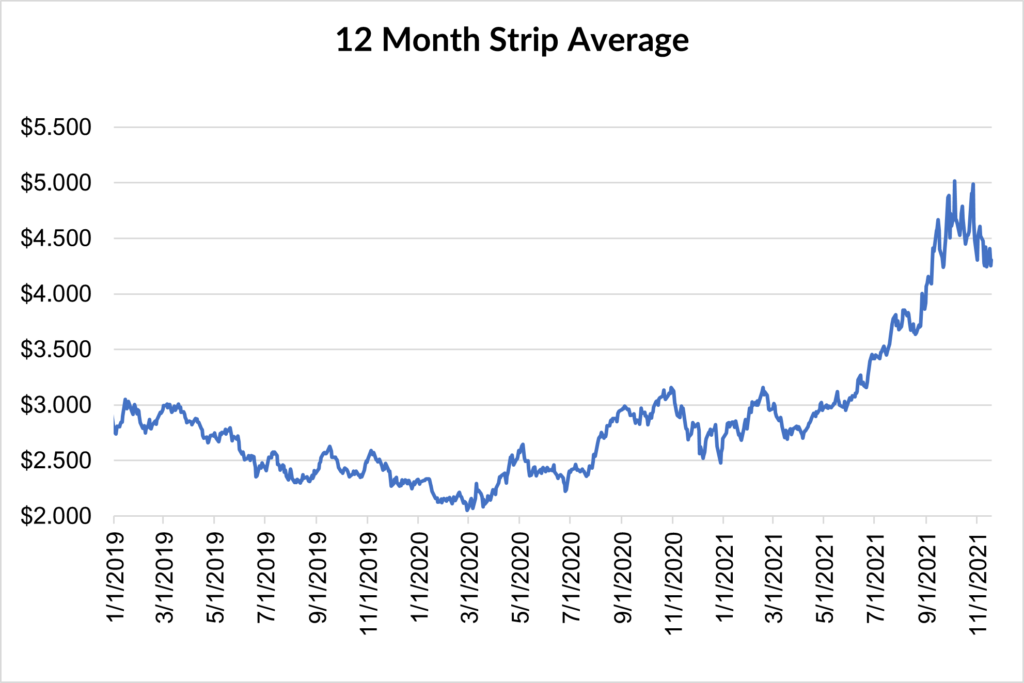

12 Month Strip

Settled Thursday at $4.303/Dth, down 11.6 cents from the prior week.

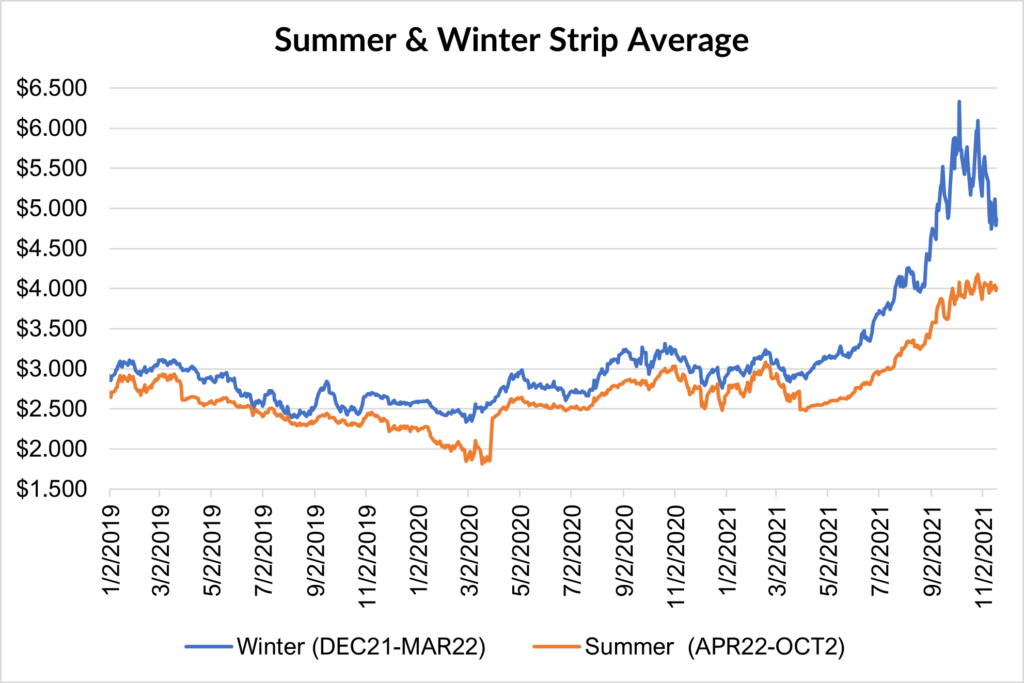

Seasonal Strips

The winter strip (DEC21-MAR22) settled Thursday at $4.868/Dth, down 21.0 cents from the week prior. The summer strip (APR22-OCT22) settled Thursday at $4.007/Dth, down 7.0 cents from the week prior.

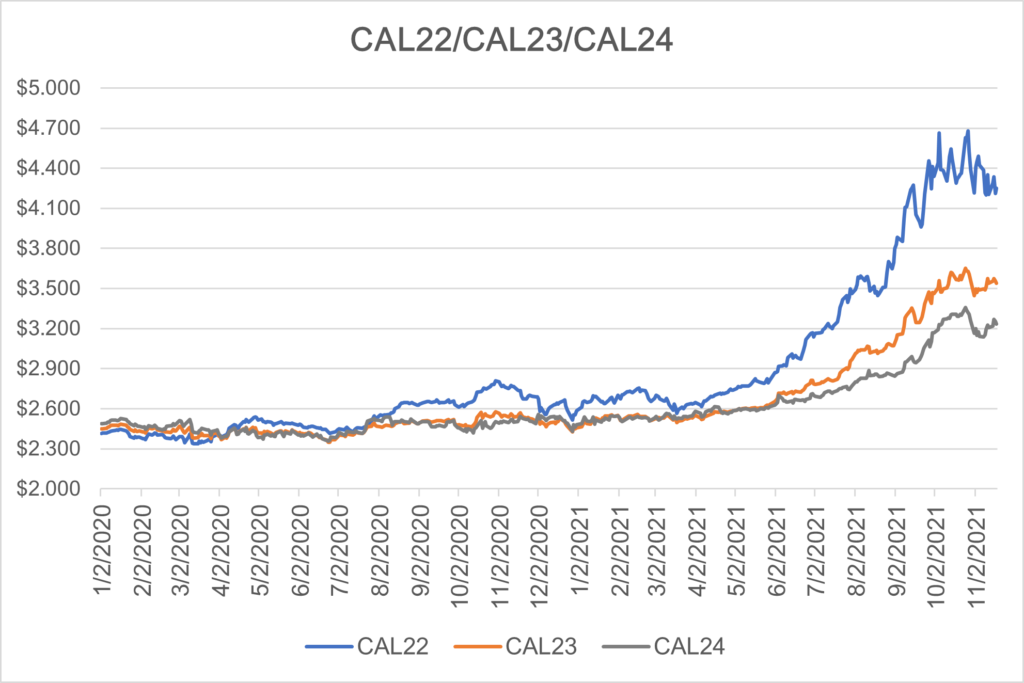

Calendar Years 2022/2023/2024

CY22 settled Thursday at $4.252/Dth, down 10.0 cents from the prior week.

CY23 settled Thursday at $3.539/Dth, down 3.5 cents from the prior week.

CY24 settled Thursday at $3.232/Dth, up less than a penny from the prior week.

Prices Have You Uneasy?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.