For natural gas report week November 5, 2020, the EIA reported a net decrease in storage of 36 Bcf. The draw was in line with forecasts of withdrawals ranging from 17 Bcf to 38 Bcf, averaging 28 Bcf. Last year for the same week there was an injection of 49 Bcf and the five-year average is 52 Bcf.

Working gas in storage was 3,919 Bcf as of Friday, October 30, 2020 per EIA estimates. Inventory was 200 Bcf (5.4%) higher than last year for the same week and 201 Bcf (5.4%) more than the five-year average of 3,718 Bcf.

Natural Gas Market Recap

December NYMEX

Settled Thursday at $2.942/Dth, down 10.4 cents from Wednesday’s close at $3.046/Dth.

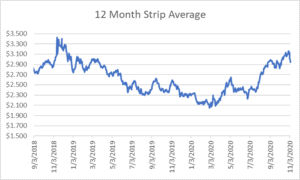

12 Month Strip

Settled Thursday at $2.947/Dth, down 16.0 cents from the prior week.

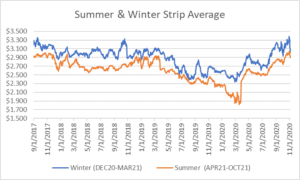

Seasonal Strips

The winter strip (DEC20-MAR21) settled Thursday at $3.015/Dth, down 31.4 cents from the week prior. Looking forward to next summer (APR21-OCT21), the strip settled Thursday at $2.894/Dth, down 8.9 cents from the week prior.

Natural Gas Weekly

Natural Gas Report – November 5, 2020

Natural Gas Fundamentals

Overall supply averaged 94.2 Bcf/d last week as production increased by 1.5%. Meanwhile, imports from Canada increased by 8.0%.

Total demand grew by 1.4% from the prior report week, averaging 95.5 Bcf/d. Residential-commercial demand grew by 20.4% upon increased consumption for heating. Consumption for power generation fell by 12.2%. Industrial demand increased by 1.4% while exports to Mexico fell by 6.9%.

LNG pipeline receipts are up by 1.1 Bcf/d, averaging a record high of 10.1 Bcf/d. Twenty-two LNG vessels with a combined carrying capacity of 82 Bcf departed the U.S. between October 29 and November 4, 2020.

The number of rigs in operation increased by 31, up to 360 according to data from Enverus. Baker Hughes rig data shows natural gas specific rigs decreased by one from last week, down to 72.