Natural Gas Monthly - August 2025

/ By

Laurie C

Current natural gas storage highlights according to the U.S. Energy Information Administration (EIA):

Natural Gas End-of-Season Storage Forecast

- Projected storage by October 31, 2025: 3,872 Bcf.

- End-of-Season total compared to 5-year average: 2% above.

- End-of-Season compared to last year: 1.24% below.

Week Ending August 15th, 2025 Natural Gas Fundamentals:

- Total natural gas storage as of August 15th was 3,199 Bcf, a build of 13 Bcf. This fell short of analysts' forecasts of 22 Bcf, mostly due to higher natural gas consumption for power generation. This was the result of increased cooling demand driven by above-average temperatures.

- In comparison, storage grew by 29 Bcf during the same week last year and injections have averaged 35 Bcf over the last five years.

- Storage for this period is 95 Bcf less than last year at this time and 174 Bcf above the five-year average of 3,025 Bcf.

- Inventory was +5.8% above the five-year (2020–24) average. Comparatively, on March 28th, at the start of injection season, it was -4%.

Natural Gas Market Trends for August 2025:

- Prompt month prices have steadily declined across August, falling as low as $2.752/Dth on August 20th. That marks a drop of more than 30% from this injection season's high.

- The 12-month strip has also weakened to under $3.800/Dth, prices not seen since January 2025.

- The EIA also revised its price outlook in the August Short Term Energy Outlook, anticipating natural gas prices will rise to $3.900/Dth in the fourth quarter of 2025 and $4.300/Dth in 2026. Their forecast is predicated on flat production and increasing LNG exports. It's worth noting here that LNG exports remained high through the first half of the year but demand at major export terminals started to drop in August. Sabine Pass fell from 4.5 Bcf/d to 3.7 Bcf/d and Cameron LNG fell from 2 Bcf/d to 1.3 Bcf/d, dragging total demand down to a two-month low.

The overall optimistic natural gas storage picture is driven by:

- Higher-than-expected production in Q2 2025.

- Lower power sector demand due to milder U.S. summer weather.

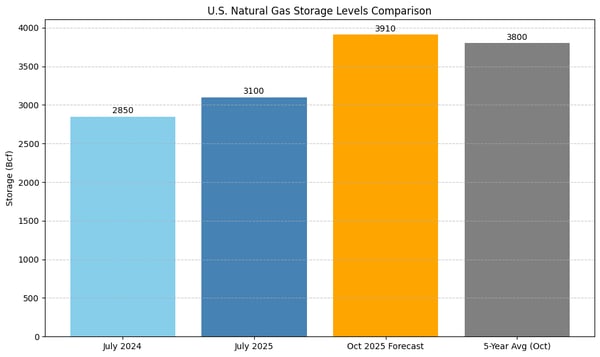

Below is a chart comparing U.S. natural gas storage levels across key points:

This forecast hints at a well-supplied market heading into winter, with storage expected to exceed the historical norm.

Natural Gas What To Watch

- While oil rig counts have dropped by more than 70 from last year at this time, natural gas rigs have grown by more than 25, supporting this season's strong production.

- As natural gas futures prices remain subdued, will capital investment in drilling projects likewise drop? If so, will a drop in production collide with surging demand from power generation needed to sustain the AI/data center explosion?

- Should those two factors converge, the price outlook for 2026 may quickly change.

- However, at present, there's nearly 100,000 MW new natural-gas fired capacity in pre-construction. That's over six times last year’s figure.

How will these factors shape natural gas prices in the upcoming months? It's too soon to tell, but we will be watching as this develops.