Natural Gas Monthly - March 2024

Based on your feedback, we have decided to resume publication of our natural gas updates. However, to ensure we are regularly providing content that is valuable for both understanding markets and informed decision making, we will issue the reports on a monthly basis.

Now, a bit of catch up…

Since our last issue, natural gas prices have dropped substantially. While the basics like a warm winter and record production have certainly worked to keep prices low, one interesting change is a standout.

On January 26th, the Biden Administration announced a pause on approvals of LNG exports from new projects. According to a White House brief on the matter, “The current economic and environmental analyses DOE uses to underpin its LNG export authorizations are roughly five years old and no longer adequately account for considerations like potential energy cost increases for American consumers and manufacturers beyond current authorizations or the latest assessment of the impact of greenhouse gas emissions.”

And even with the recognition that the U.S. is already the number one exporter of LNG worldwide, with exports expected to double by the end of this decade, and an increasing European reliance on U.S. LNG in a shift away from Russian exports, LNG has fallen under scrutiny from climate activists. Meanwhile, others from energy producers to European allies have voiced opposition to the decision.

LNG Export Pause - The Facts

- The Natural Gas Act of 1938 requires natural gas exports to foreign countries be approved by the Department of Energy.

- To date, the Department of Energy has not denied approval for any such project.

- Approvals are ordered unless found contrary to public interest.

- The current pause is intended to allow the administration to weigh economic and environmental consequences of LNG exports, thereby in the name of public interest.

- The Biden administration affirmed this only impacts LNG export agreements with countries not covered by a Free Trade Agreement with the United States.

- Additionally, the pause is only intended to affect new projects which have not yet been approved. The scope of precise impact remains undefined and exactly how long the pause may last is still in question, although recent statements by Energy Secretary Jennifer Granholm suggest it will end within a year.

- An opposition bill passed the House but is unlikely to pass the Senate or receive Biden’s approval.

The Consequences

One may be inclined to make the assumption that more natural gas at home translates to more supply and lower prices. That’s only part of the picture. Historically, once prices fall low enough, profits shrink and producers tighten up production until investor confidence is restored. Despite efforts to keep more gas at home and prices low for U.S. consumers, the consequences of the pause may very well result in subdued production and higher prices.

Indeed, according to the EIA this has already started to occur. “Because of low natural gas prices, some producers have announced curtailments in production or reductions in capital expenditures toward natural gas-directed activities in 2024.”

Natural Gas Breakeven

What is it?

Generally, breakeven is the average price at which a producer needs to sell to neither lose money nor make a profit. According to recent data from Bloomberg New Energy Finance, breakeven prices vary by production basin:

“Even for highly efficient operators with the highest-quality acreage, the Henry Hub breakeven price for Haynesville gas is currently estimated at $2.67/MMBtu. For producers looking to return 30% free cash flow -- a reasonable metric for Wall Street investors these days -- that wellhead clearing price rises to $3.21/MMBtu for class-1 and $3.57/MMBtu for class-2 acreage, S&P Global Commodity Insights estimate show.”

Natural Gas - Other Fundamentals

Absent a cataclysmic event (or global pandemic) natural gas prices seldom boil down to just one factor. As such, the Biden administration's decision has merely inflamed bearish supply and demand fundamentals that persisted over much of winter. Let’s take a quick look at those.

- High Production. According to the EIA, natural gas production reached an all-time monthly high of 105.5 Bcf/d in December 2023. In 2023, production increased 3.7% Bcf/d from 2022. Additionally, production increased 3.8 Bcf/d in 4Q23 compared with the average for the first three quarters of 2023.

- Subdued Demand. The CME group explained, "One of the warmest winters on record in the United States has created a natural gas glut. An extremely mild winter has caused demand for natural gas for electricity and space heating to plummet."

- Oversupply. While production remained at an all-time high and declining natural gas consumption in the residential and commercial sectors, working natural gas inventories were 11% above the year-ago level and 10% above the five-year average heading into the end of 2023. According to nasdaq.com, "North American gas markets might remain weak through early 2024 due to a combination of factors: higher-than-average underground gas storage inventories, potential warmer-than-normal winter temperatures, weak consumption from industrial and commercial sectors, and strong production growth from key U.S. basins. These factors are expected to keep natural gas inventories at elevated levels through the winter months, leading to restrained prices in the near term."

Natural Gas Price Outlook

It’s difficult to predict how quickly stifling production will materialize and the ways it could collide with demand to shape the market. However, if above-average temperatures find us this summer, it would likely spark increased cooling-related demand. If the two coincide, it may provide some price support.

Natural Gas Monthly Market Report - March 2024

Natural gas market snapshot as of week beginning March 10th, 2024.

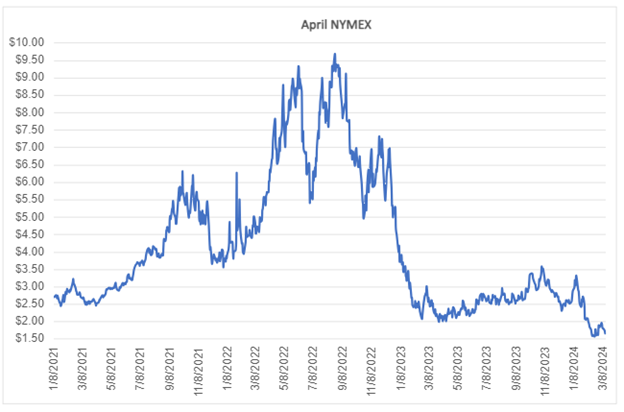

April NYMEX

April NYMEX: April settled Tuesday, March 12th at $1.714/Dth down 4.5 cents from Monday’s close at $1.759/Dth and down 24.3 cents from the prior week.

12 Month Strip

12 Month Strip: Settled Tuesday, March 12th at $2.693/Dth, down 16.8 cents from the prior week.

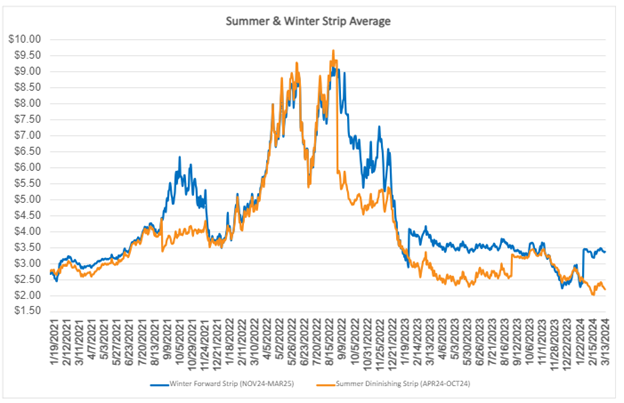

Seasonal Strips

Seasonal Strips: The summer strip (APR24-OCT24) settled Tuesday, March 12th at $2.218/Dth, down 20.3 cents week-over-week while the winter strip (NOV24-MAR25) settled at $3.358/Dth, down 11.9 cents from the prior week.

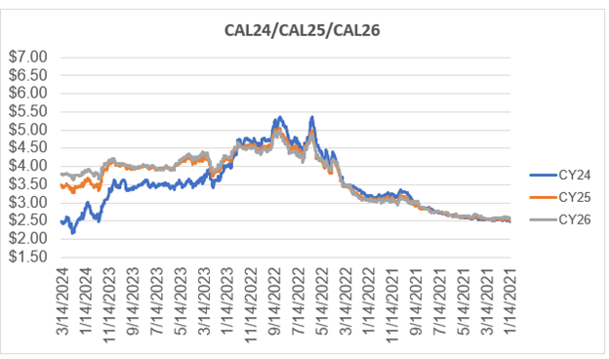

Calendar Years 2024/2025/2026

CAL24/CAL25/CAL26:

CY24 settled Tuesday at $2.431/Dth, down 18.6 cents from the prior week.

CY25 settled Tuesday at $3.421/Dth, down 9.1 cents from the prior week.

CY26 settled Tuesday at $3.775/Dth, down 3.3 cents from the prior week.