Natural gas report week, April 21, 2022. The week-over-week downward price trends shown in today’s market report belie the early week volatility that saw front month trading break $8.000/Dth just after noon on Monday. It’s prompted some analysts to speculate that forecasting a ceiling, if one exists, may prove difficult. Other outlets have described prices as “crazy,” suggesting the path to $10 - gas is becoming more of a realistic possibility.

While it’s not quite time to apply the same apocalyptic fascination that has us naming snowstorms and keeping the Weather Channel on 24/7 to monitor The Next Big Hurricane, it might be reasonable to apply Thunderstorm Watch mentality here.

Is it going to storm? Maybe. The meteorologists aren’t ready to commit, but the conditions are right for a storm to develop. The more data they have, the higher their certainty about how the forecast will unfold. That’s where we are with this.

Natural Gas Weekly Fundamentals

As domestic natural gas prices have remained strong throughout April – at a point in the season fundamentals relax and prices soften – it makes sense to identify a few of the factors that we should watch as an indicator of where prices may go.

U.S. LNG Demand – As Europe continues to shift away from Russian natural gas imports, demand for U.S. LNG will remain high.

Summer Heat and Power Generation – There’s early thought this summer may sizzle, more so than normal. If that happens, it will increase natural gas demand for power generation. With hydro and nuclear generation depressed and coal becoming increasingly more expensive, reliance on natural gas will remain high.

Production – Although production has gradually recovered from pandemic lows, it’s not been sufficient to significantly chip away at the storage deficit. In fact, in recent weeks, many analysts have adjusted their end of injection season storage totals down, anticipating a tighter supply-demand balance.

As it stands, this alone isn’t immediately suggestive of $10 – gas. However, it does mean we shouldn’t expect last year’s lows either. We’ll be keeping an eye on natural gas developments to keep you informed about market shifts.

Natural Gas Market Report – April 21, 2022

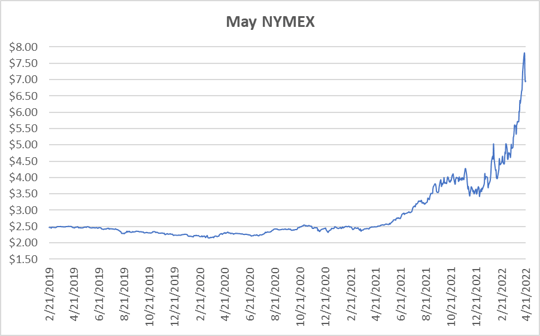

May NYMEX

May settled Thursday at $6.957/Dth, up 2.0 cents from Wednesday’s close at $6.937/Dth, but down 4.0 cents over the prior week.

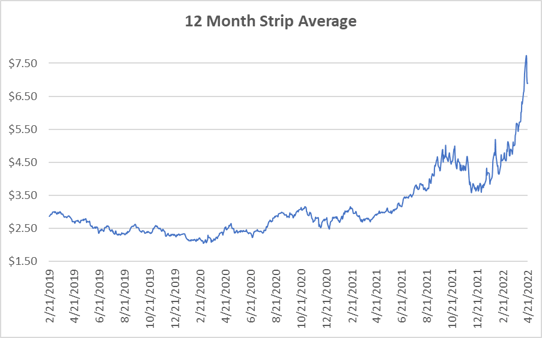

12 Month Strip

Settled Thursday at $6.893/Dth, down 6.5 cents from the prior week.

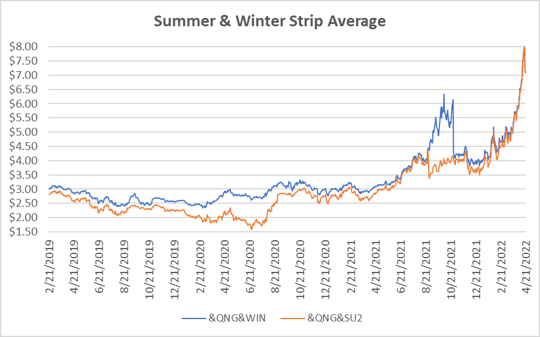

Seasonal Strips

The summer strip (MAY22-OCT22) settled at $7.121/Dth, down less than a penny from the week prior. The winter forward (NOV22-MAR23) settled Thursday at $7.115/Dth, down 8.2 cents from the week prior.

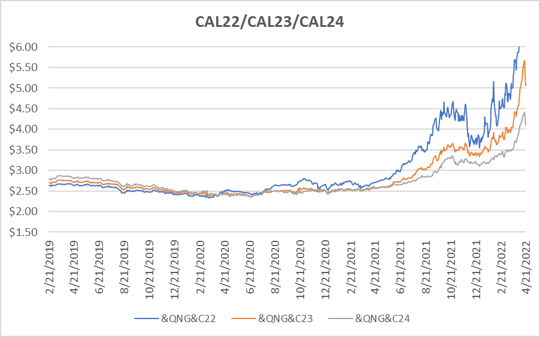

Calendar Years 2022/2023/2024

CY22 settled Thursday at $7.171/Dth, down less than a penny from the prior week.

CY23 settled Thursday at $5.055/Dth, down 25.6 cents from the prior week.

CY24 settled Thursday at $4.097/Dth, down 17.2 cents from the prior week.

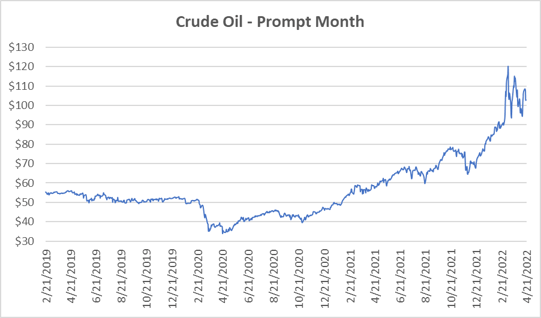

Crude Oil

Settled Thursday at $103.79/barrel, unchanged from the prior week.

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.

.png)