Prices fell across natural gas report week, February 10, 2022 giving up much of their gains from the prior two weeks. This week’s draw from storage of 222 Bcf fell in line with projections and drove the current deficit to the five-year average to 444 Bcf. Nonetheless, with only seven weeks left in withdrawal season, and NOAA forecasts pointing to above-average temperatures for much of the country through May, under the current scenario, impact to end of season storage totals will be constrained and upside potential will be limited. However, should forecasts reverse course, near-term volatility is likely to return.

Natural Gas Market – A Brief Recap

Moderating temperatures led to a decline in heating-related demand but a slight increase in consumption for power generation. Overall supply fell 2.8 Bcf/d as production declined 3.4 Bcf/d, due in part to wellhead freeze offs.

With little left to substantially move the needle on storage totals before the end of withdrawal season, the price outlook has shifted bearish. This week, the prompt month, 12-month and seasonal strips all posted losses of more than fifty cents. Likewise, CY22 and CY23 posted losses. Interestingly, CY24 gained 7.0 cents week over week, with the most substantial growth for 2024 found in warmer months, April through October.

Presently, the average rate of withdrawal from storage is 8% higher than the five-year average. If that rate keeps pace with the five-year average of 11.8 Bcf/d until the end of withdrawal season on March 31, total inventory will be 1,451 Bcf, which is 215 Bcf lower than the five-year average of 1,666 Bcf.

Here’s your weekly reminder there’s 37 days left until spring, but who’s counting?

APR22, settled at $3.943/Dth down 77.7 cents

MAY22, settled at $3.977/Dth down 74.8 cents

JUN22, settled at $4.029/Dth down 73.3 cents

JUL22, settled at $4.085/Dth down 72.5 cents

AUG22, settled at $4.098/Dth down 71.7 cents

SEP22, settled at $4.083/Dth down 71.1 cents

Natural Gas Market – A Brief Recap

This week, the EIA released their February Short-Term Energy Outlook (STEO). If you are interested in reading the full natural gas forecast, you can read the complete edition here. For everyone else content with just the highlights, here goes…

- Natural gas prices are expected to average $3.92/MMBtu in 2022 and $3.60/MMBtu in 2023.

- Favorable prices will lead to increased profitability which will spur increased drilling, specifically in new wells. In fact, production from new wells will average 18.1 Bcf/d in 2022 and increase to 37.8 million b/d in 2023.

- The additional drilling will support record-breaking production which is projected to average 106.6 Bcf/d in 2023.

Natural Gas Market Report – February 10, 2022

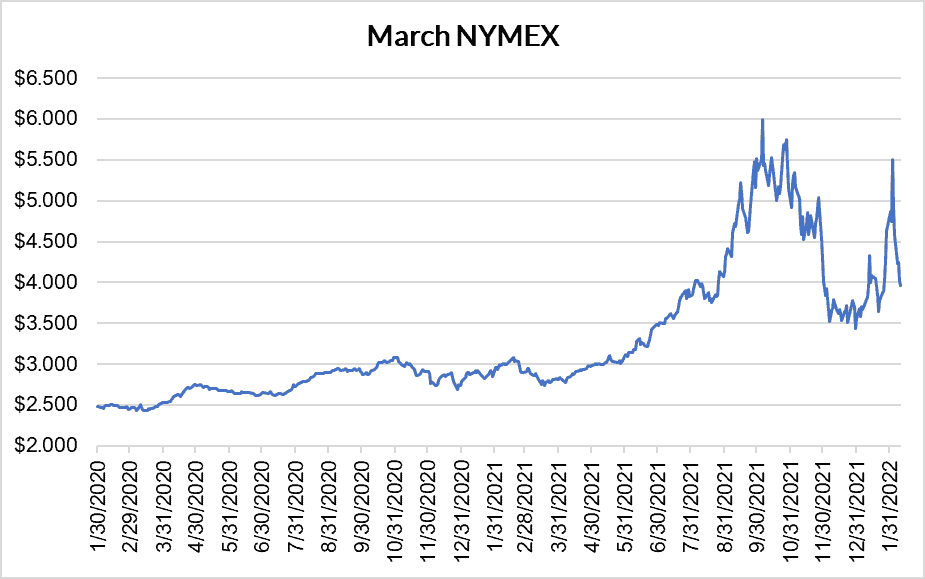

March NYMEX

March settled Thursday at $3.959/Dth, down 5.0 cents from Wednesday’s close at $4.009/Dth and notably down 92.9 cents week-over-week.

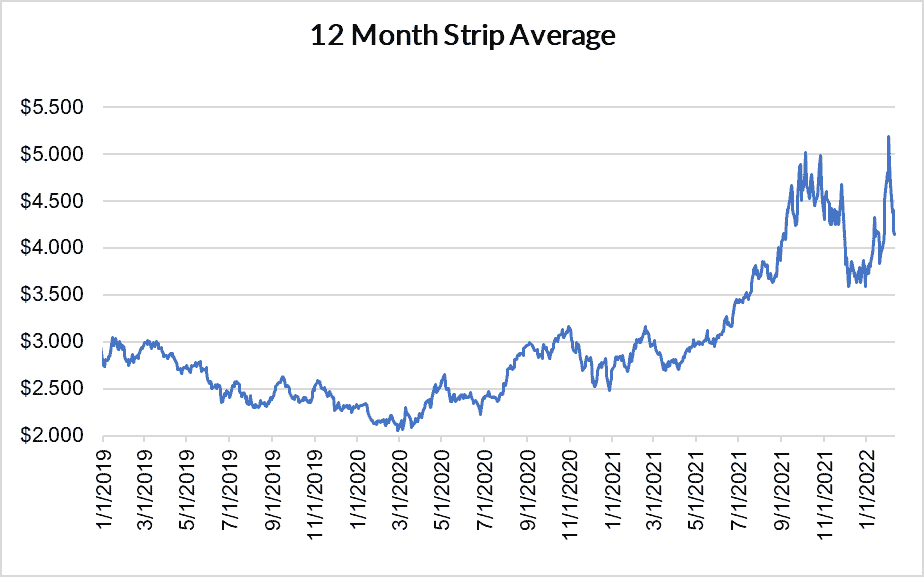

12 Month Strip

Settled Thursday at $4.145/Dth, down 72.3 cents from the prior week.

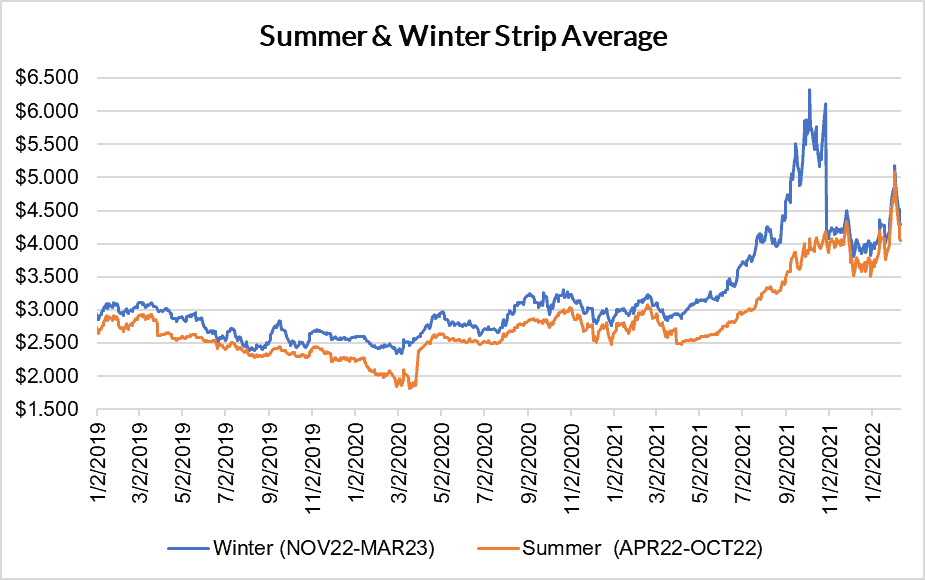

Seasonal Strips

The upcoming summer strip (APR22-OCT22) settled at $4.046/Dth, down 73.1 cents from the week prior.

The winter forward (NOV22-MAR23) settled Thursday at $4.297/Dth, down 61.4 cents from the week prior.

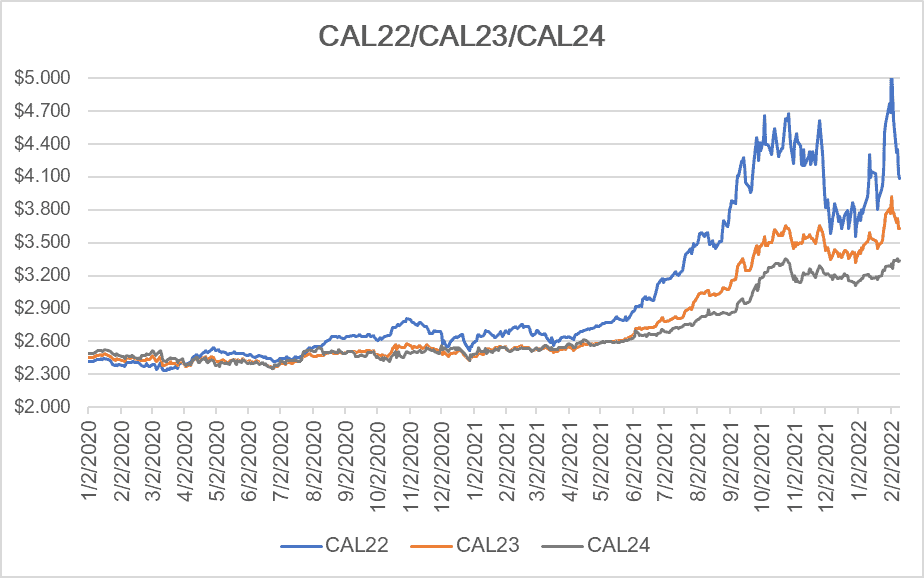

Calendar Years 2022/2023/2024

CY22 settled Thursday at $4.088/Dth, down 74.0 cents from the prior week.

CY23 settled Thursday at $3.630/Dth, down 16.7 cents from the prior week.

CY24 settled Thursday at $3.335/Dth, up 7.0 cents from the prior week.

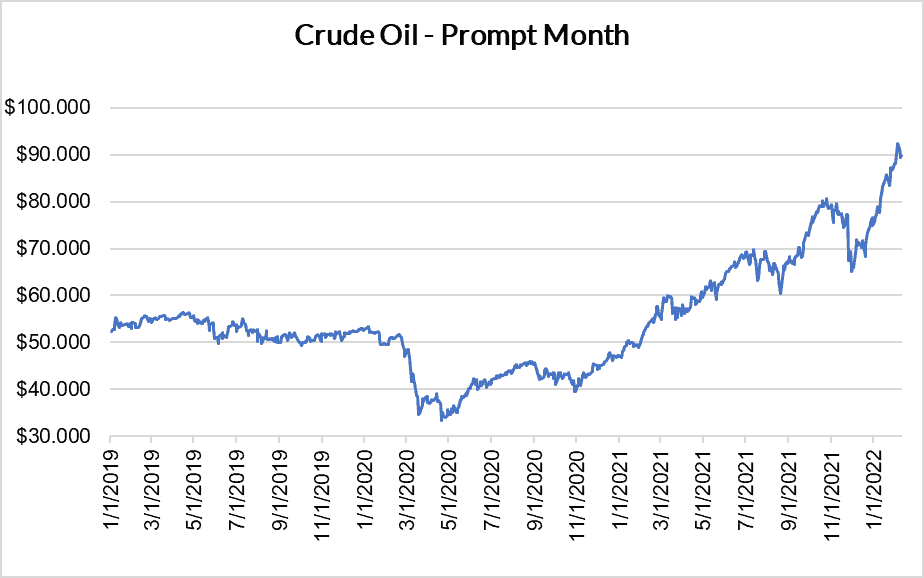

Crude Oil

Settled Thursday at $89.88/barrel, down 39.0 cents from the prior week.

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.