Natural gas report week, February 3, 2022 was marked by the same volatility that has fueled natural gas markets since the second half of 2021. Aggravated by forecasts of a substantial winter storm reminiscent of last year’s deep freeze at nearly the same point into the year, both spot prices and futures spiked before settling down today. Even with this week’s substantial draw of 268 Bcf and projections of a growing end-of-season storage deficit to the five-year average, it wasn’t enough to sustain the early-week rally.

As European markets calm and trading reorients on traditional winter fundamentals, with eight weeks left in withdrawal season, it’s beginning to look like it may take something substantial to provoke lasting price movement in either direction.

For a closer look at last week’s news and where we may be headed, keep reading…

Natural Gas Market – The Blue Streak Edition

If you’ve been to Cedar Point, you’re likely familiar with the Blue Streak. With start to finish quick highs and lows that bring you up out of your seat before a whiplash turn at the finish, it’s over before you have time to process what just happened. That was the last seven days in the natural gas market.

The click-click-click as you climb the first hill leaves you mildly apprehensive. The climb doesn’t appear too steep, but you get the sense that might be an illusion. Either way, you don’t get much time before the ascent is over and you’re on your way back down. Again…the market across the last week. With the sting of February 2021 lingering at the back of our minds, forecasts for a massive snowstorm stretching from Texas to Michigan and predictions for below-zero wind chills filled market watchers with first-hill apprehension.

Not to worry. It didn’t last long. Despite a 268 Bcf withdrawal from storage that exceeded last year’s draw (183 Bcf) and the five-year average of withdrawals (150 Bcf), by Wednesday, the market was on the way back down. March opened the day at $5.420/Dth before trading down more than 50.0 cents by the close of the day. Although not as steep, April-September all posted similar losses of more than 20.0 cents.

What’s more is that up to this point in withdrawal season, the pace of withdrawals from storage has been below the five-year average. This week, that trend reversed. Presently, the average rate of withdrawal from storage is 3% higher than the five-year average. If that rate keeps pace with the five-year average of 12.9 Bcf/d until the end of withdrawal season on March 31, total inventory will be 1,523 Bcf, which is 143 Bcf lower than the five-year average of 1,666 Bcf.

However, with this week’s weather likely to generate another above-norm withdrawal and more of the same expected through the end of February, it’s possible the ride isn’t over quite yet. Additionally, well-head freeze offs may intensify currently mild supply shortfalls. According to Natural Gas Intelligence, “Meanwhile, pipeline data showed freeze-offs already reaching 4-5 Bcf/d below average January production with subfreezing weather expected to extend and supply losses to potentially worsen.” Yet, with spring quickly approaching, it’s reasonable the impact will be limited.

And on that note, here’s your official reminder there’s 44 days left until spring and 13 weeks,1 day until Cedar Point reopens.

APR22, settled at $4.720/Dth up 51.3 cents

MAY22, settled at $4.725/Dth up 49.2 cents

JUN22, settled at $4.762/Dth up 48.7 cents

JUL22, settled at $4.810/Dth up 48.5 cents

AUG22, settled at $4.815/Dth up 48.3 cents

SEP22, settled at $4.794/Dth up 48.4 cents

Natural Gas Market Report – February 3, 2022

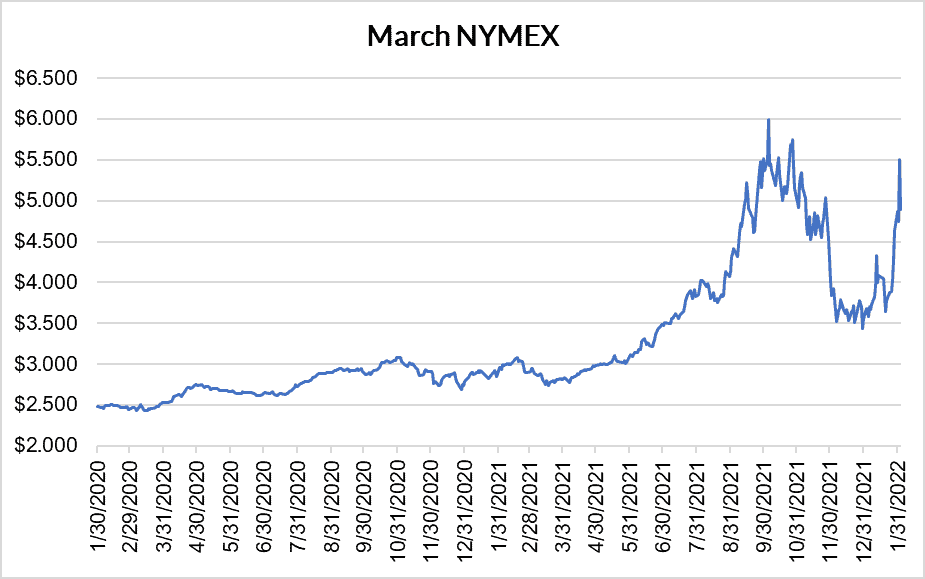

March NYMEX

March settled Thursday at $4.888/Dth, down 61.3 cents from Wednesday’s close at $5.501/Dth but up 60.5 cents week-over-week.

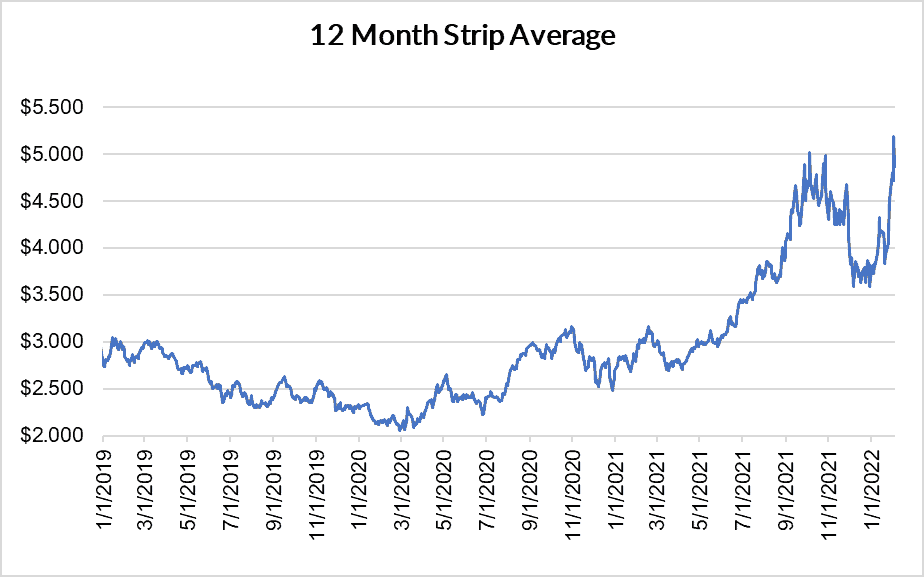

12 Month Strip

Settled Thursday at $4.868/Dth, up 35.1 cents from the prior week.

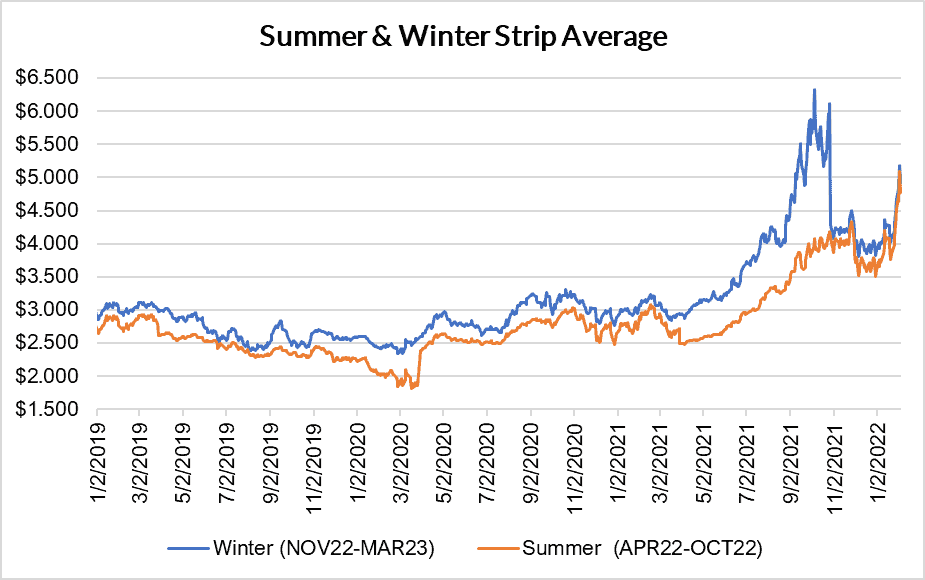

Seasonal Strips

The upcoming summer strip (APR22-OCT22) settled at $4.777/Dth, up 48.9 cents from the week prior.

The winter forward (NOV22-MAR23) settled Thursday at $4.911/Dth, up 45.0 cents from the week prior.

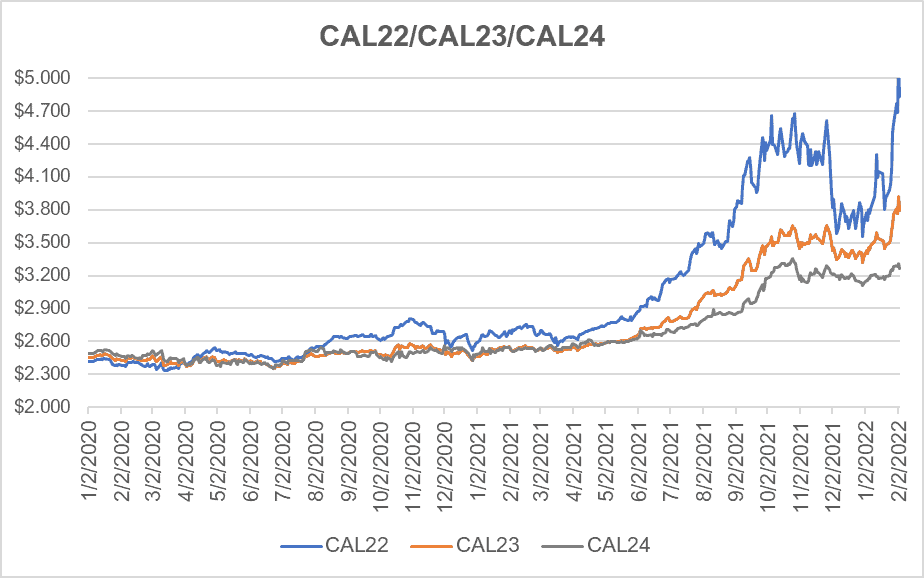

Calendar Years 2022/2023/2024

CY22 settled Thursday at $4.828/Dth, up 32.4 cents from the prior week.

CY23 settled Thursday at $3.797/Dth, up 13.5 cents from the prior week.

CY24 settled Thursday at $3.265/Dth, up 1.6 cents from the prior week.

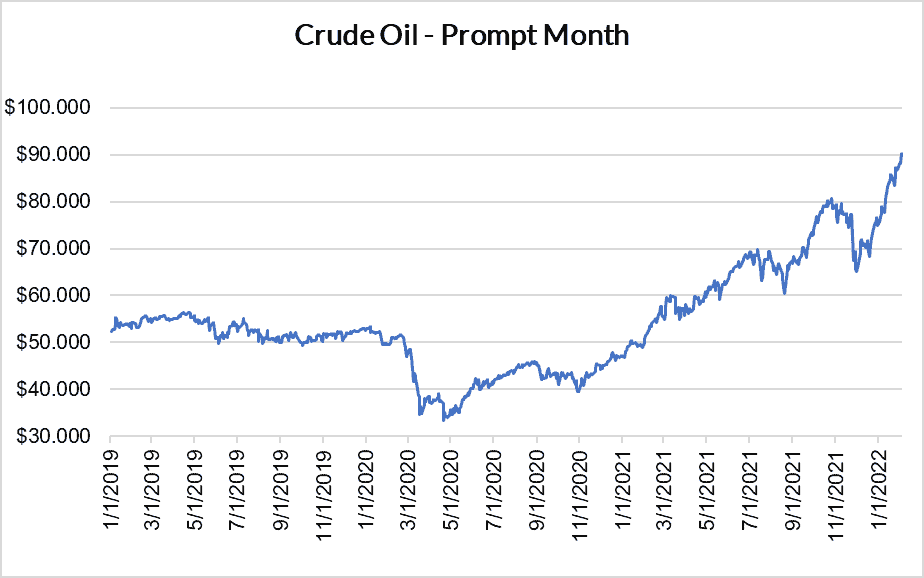

Crude Oil

Settled Thursday at $90.27/barrel, up $3.66 from the prior week.

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.