Natural gas report week, May 12, 2022.

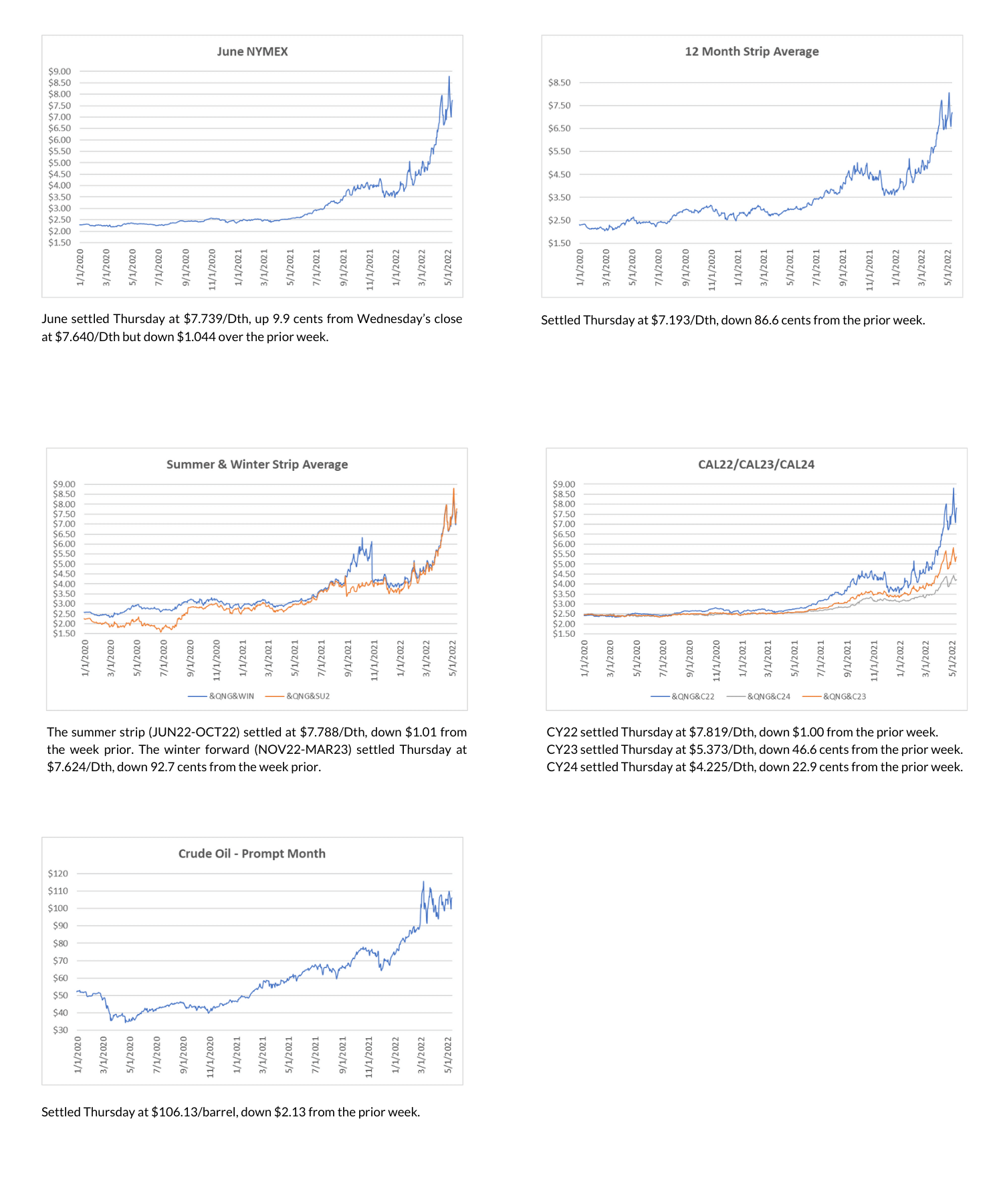

This week’s injection of 76 Bcf was in line with analysts’ expectations which ranged from 64-86 Bcf. With production and demand steady and temperatures moderating across the report week, the market gave up some of the prior week’s astronomical gains.

Nonetheless, the continued deficit to both last year’s numbers and the five-year average has prompted early-season preoccupation with end-of-season storage totals. With hints of above-average summer temperatures and low power generation stores of both coal and natural gas, should forecasts realize, it’s fair to acknowledge that we’ve not seen the last of natural gas price runs this summer.

Natural Gas Weekly Analysis

Coal

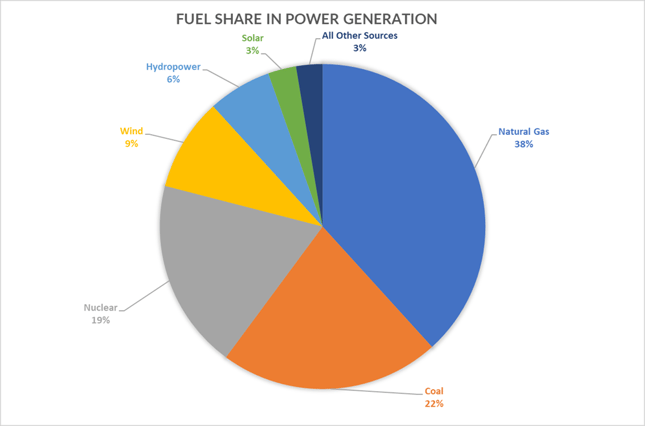

In January 2022, natural gas consumption for power generation averaged 31.6 Bcf/d, the highest amount on average for any winter month in recorded history. Certainly below-average temperatures contributed to the increased demand, but more notably, declining coal supplies led to increased coal prices.

Coal stocks, in fact, fell to 80 million tons in September 2021, a level not experienced since March 1978. The EIA explained, in addition to extremely low stores of coal, increased generation at coal plants further depleted stockpiles. “As U.S. coal plants have retired and remaining plants are used less, the country’s total coal stockpiles have declined. In addition, increased electricity generation by coal plants during the summer of 2021 also reduced coal inventories.”

The increased cost of coal made it a less profitable alternative to natural gas. Additionally, as coal plants have retired, coal-fired plants have been replaced by natural-gas fired plants.

As such, “…many U.S. mines have begun to close. Reduced production capacity and supply chain disruptions have created some concerns about the ability of coal-fired generators to replenish stockpiles to last through the winter. Electric grid operators are closely monitoring coal inventories this winter.”

Weather Forecasts

Given concerns about the ability to meet power generation demand with current coal supplies and already high natural gas prices, the market has remained hypersentitive to weather forecasts for above average heat throughout the summer.

Indeed should forecasts hold accurate, end-of-season storage concerns may produce high prices leading into winter.

Pew Study: American Energy Insights

A May 12 Pew Study Revealed a few interesting insights about American knowledge and beliefs about domestic energy consumption and production. I’ll include a couple here and if you’re interested, you can find the remainder of the survey results here.

- “Overall, 28% of Americans say correctly that the U.S. produces most of the energy it uses inside of the U.S. Roughly a quarter (27%) say they’re not sure where most of the energy that the U.S. uses is produced. The remainder say either that the U.S. imports most of its energy (19%) or that it produces about half and imports about half of the energy it uses (25%).”

- “As much of Europe grapples with how to reduce its dependence on Russian oil and gas, 61% of Americans say they would favor the United States expanding production to export large amounts of natural gas to European countries. A smaller share (37%) say they would oppose expanding natural gas production to export to countries in Europe.”

Natural Gas Market Report – May 12, 2022

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.

.png)