.png)

Natural Gas Weekly – November 3, 2022

Natural Gas – Week In Review

Natural gas report week November 3, 2022.

This week’s injection of 107 Bcf was at the high end of analysts’ expectations which ranged from 87 Bcf to 109 Bcf. Comparatively, last year’s injection was 66 Bcf and the five-year average of net injections is 45 Bcf. Current storage totals 3,501 Bcf which is 3.7% below the five-year average but still within the five-year historical range.

Natural Gas Weekly Fundamentals

- Demand - Overall demand rose by 2.7%, growing by 1.8 Bcf/d week over week. The largest increase in consumption came from heating-related demand, up 2.5 Bcf/d. The LNG export ship count fell by one, totaling 21 for an overall capacity of 78 Bcf.

- Production - Production added 0.5 Bcf/d, for a third consecutive week, once again offsetting another decline in imports from Canada. The natural gas rig count dropped by one from the week before, totaling 156 rigs. Oil-directed rigs fell by 2, for a total of 610.

- Storage Forecast - Although, by the calendar, injection season closed October 31, analysts anticipate it may continue for two to three more weeks with injections ranging from 70 Bcf to 90 Bcf. Even at the low end of that range, an additional three weeks of 70 Bcf injections will erase the deficit to the five-year average. That’s a substantially different result than what was anticipated. Even mid-summer forecasts saw us closing injection season at a deficit of over 300 Bcf compared to the five-year average. Not too shabby.

Natural Gas Prices

Natural gas MYNEX futures prices were up and down across the report week as technical trading and cooling weather forecasts pushed prices higher before the EIA reported a weekly storage build of 107 Bcf this Thursday. More than double the five-year average of net injections, this week’s addition to storage quickly subdued prices.

Even though most analysts agree we likely have at least two more weeks of storage injections, it’s unlikely we’ll see prices drop drastically as the market seems to have already accounted for a warm November and a short-term future of weekly storage additions. Is it possible the market has refocused on fundamentals? We’ll see.

Natural Gas Weekly Market Report - November 3, 2022

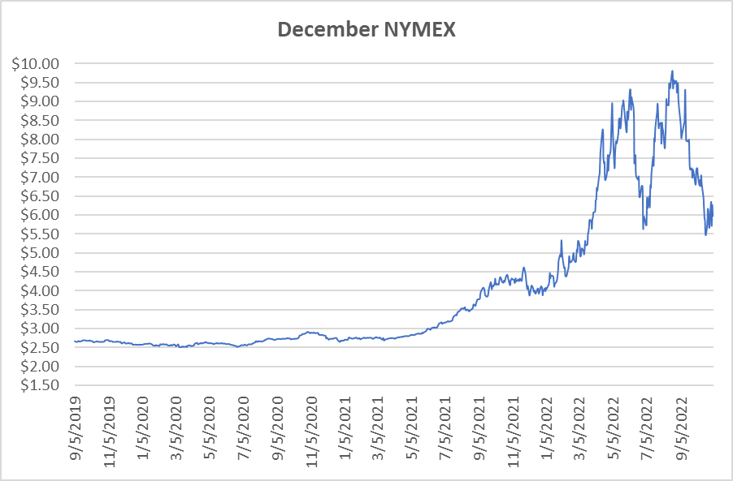

December NYMEX

December NYMEX: December settled Thursday at $5.975/Dth down 29.3 cents from Wednesday’s close at $6.268/Dth, but up 10.0 cents from the prior week.

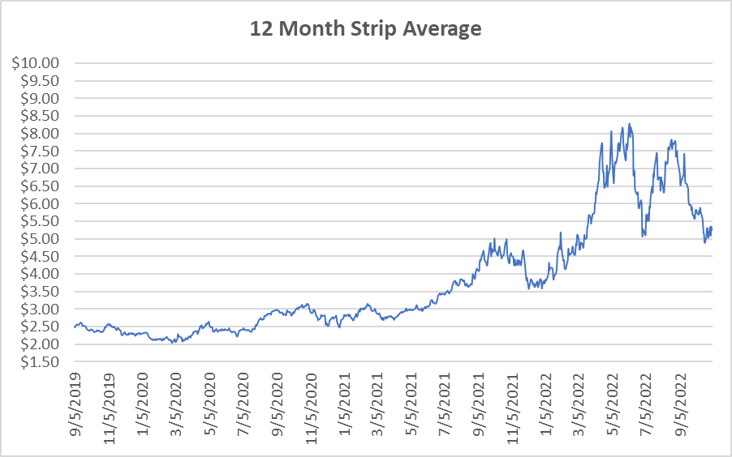

12 Month Strip

Settled Thursday at $5.250/Dth, up 10.7 cents from the prior week.

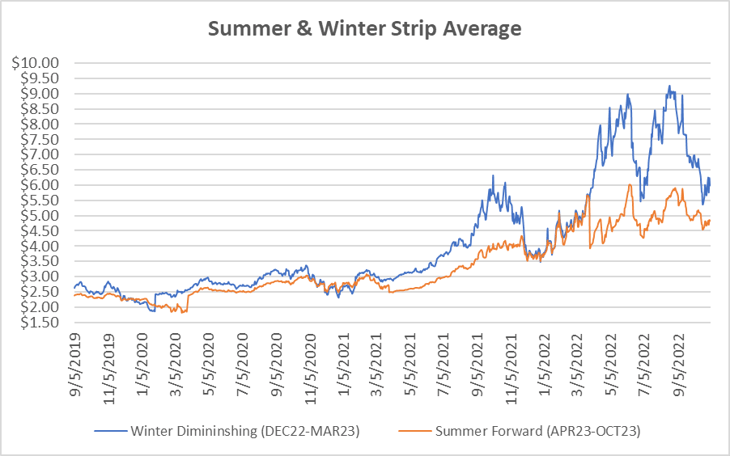

Seasonal Strips

The winter strip (DEC22-MAR23) settled Thursday at $5.995/Dth, up 27.9 cents from last week while the summer strip (APR23-OCT23) settled at $4.827/Dth, up 9.3 cents week-over-week.

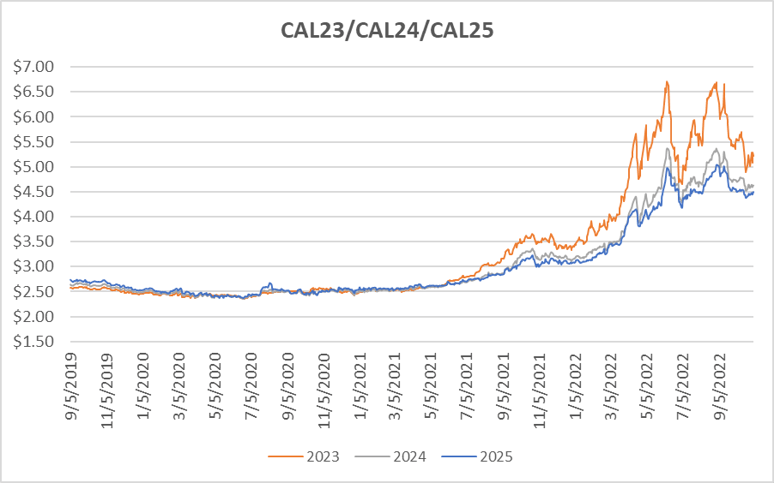

Calendar Years 2022/2023/2024

CY23 settled Thursday at $5.217/Dth, up 10.3 cents from the prior week.

CY24 settled Thursday at $4.621/Dth, up 1.9 cents from the prior week.

CY25 settled Thursday at $4.502/Dth, up 4.4 cents from the prior week.

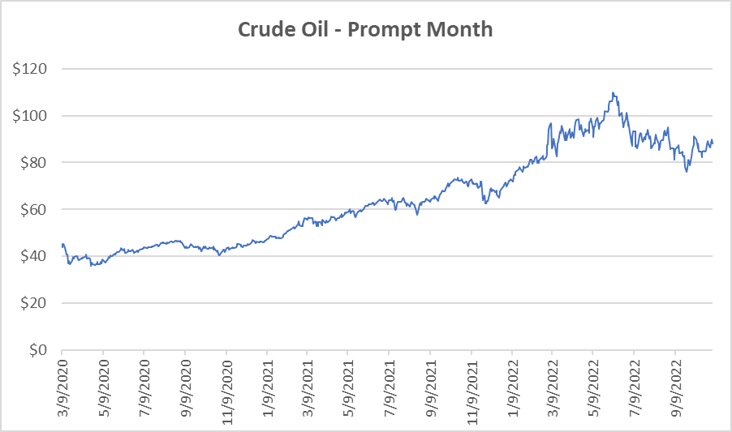

Crude Oil

Settled Thursday at $88.17/barrel, down 91.0 cents from the prior week.

Need Help Making Sense of Natural Gas Prices?

We can help you manage risk and navigate the current price volatility. We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.