.png)

Natural Gas Weekly – October 13, 2022

Natural Gas – Week In Review

Natural gas report week October 13, 2022.

This week’s injection of 125 Bcf was in line with analysts’ expectations which ranged from 116 Bcf to 137 Bcf. Comparatively, last year’s injection was 86 Bcf and the five-year average of net injections is 82 Bcf. Current storage totals 3,231 Bcf which is 6.4% below the five-year average but still within the five-year historical range.

Natural Gas Weekly Fundamentals

Demand

Overall demand grew for the first time in four weeks, adding 2.1 Bcf/d. Consumption for power generation rose by 1.3 Bcf/d while residential-commercial demand grew by 0.8 Bcf/d. The LNG export ship count declined by one, totaling 19 for an overall capacity of 70 Bcf.

Production

Production added 0.4 Bcf/d over last week. The natural gas rig count dropped by one, totaling 158 rigs. Oil-directed rigs fell by 2, for a total of 602.

Storage Forecast

The average rate of injections into storage is 3% higher than the five-year average at this point in refill season (which traditionally runs April through October). If the injection rate matches the five-year average of 8.0 Bcf/d through October 31, natural gas supply will total 3,424 Bcf, 221 Bcf lower than the five-year average of 3,645 Bcf.

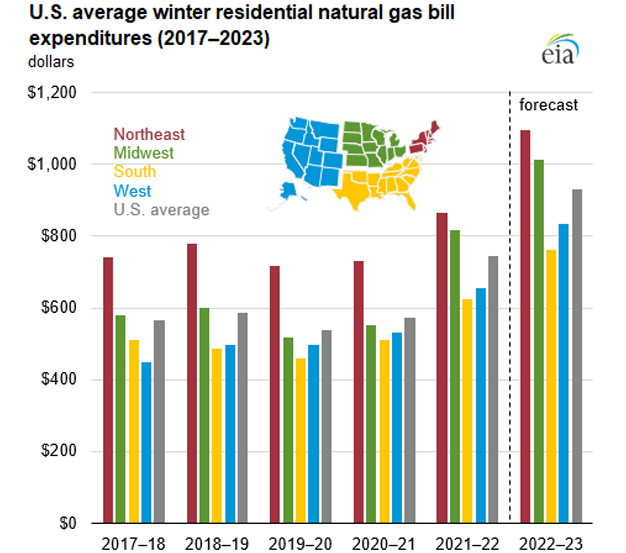

EIA Winter Retail Price Forecast

This week, the EIA published their Winter Fuels Outlook, including the annual natural gas retail price forecast. Key takeaways:

- Households that primarily use natural gas for heating will spend an average of $931 this winter, $206, or 28%, more than last year.

- Increased heating demand, based on National Oceanic and Atmospheric Administration (NOAA) winter forecasts, will contribute to increased overall costs.

- Both spot and retail prices are anticipated to be higher than last winter.

- Draws are forecast to be less than the five-year average as increased demand this winter will be offset by production growth which is projected to be 2.8 Bcf/d more than last winter.

Natural Gas Weekly Market Report - October 13, 2022

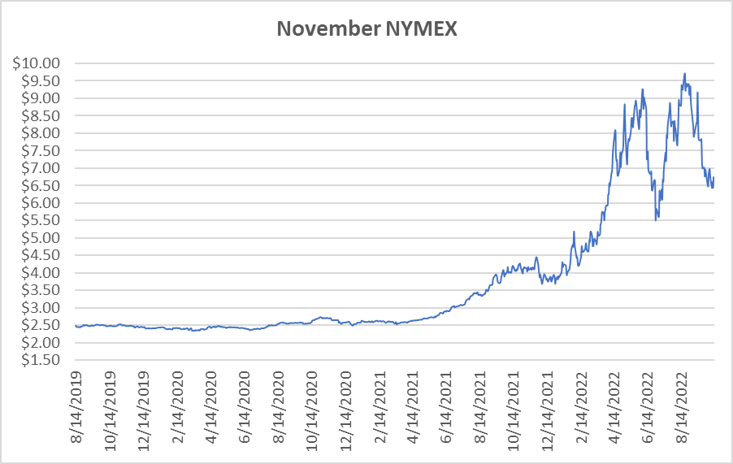

November NYMEX

Settled Thursday at $6.741/Dth up 30.6 cents from Wednesday’s close at $6.435/Dth.

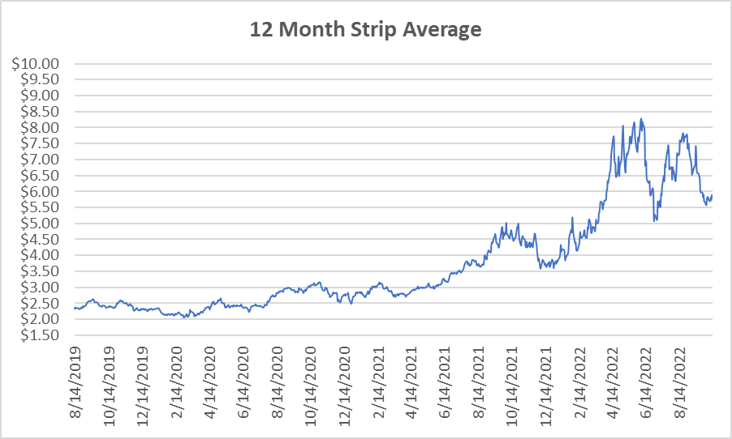

12 Month Strip

Settled Thursday at $5.888/Dth, up 7.5 cents from the prior week.

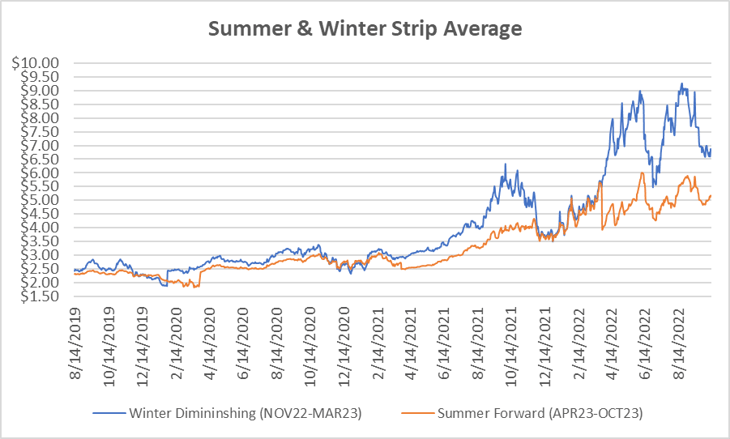

Seasonal Strips

The winter strip (NOV22-MAR23) settled Thursday at $6.992/Dth, up 11.0 cents from last week while the summer strip (APR23-OCT23) settled at $4.970/Dth, up 13.6 cents from last week.

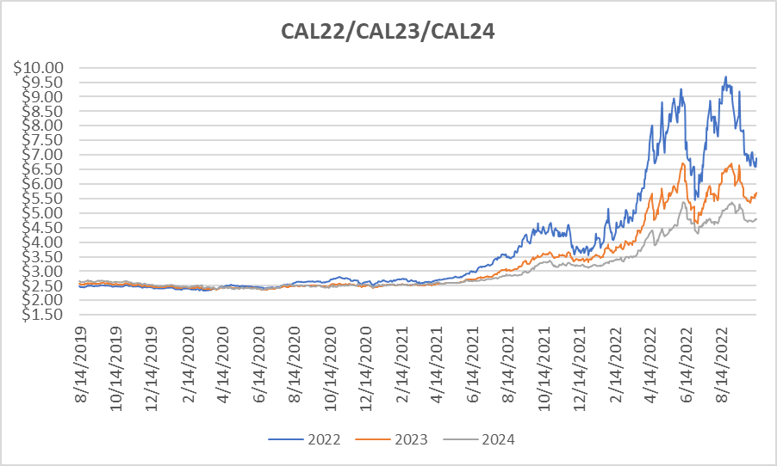

Calendar Years 2022/2023/2024

CY23 settled Thursday at $5.698/Dth, up 15.1 cents from the prior week.

CY24 settled Thursday at $4.777/Dth, up 8.5 cents from the prior week.

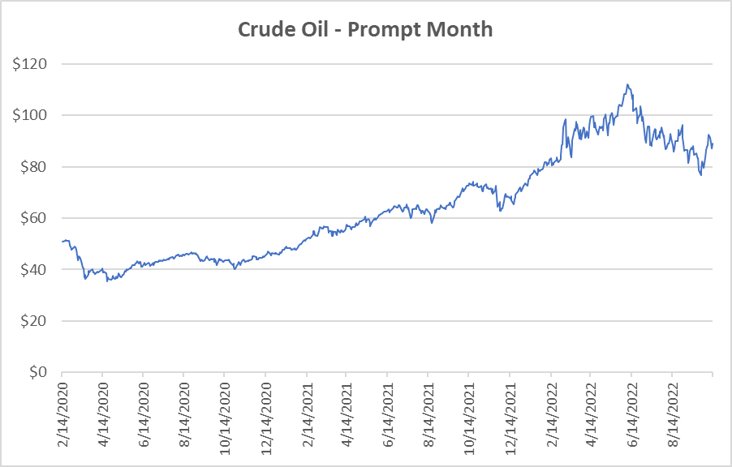

Crude Oil

Settled Thursday at $89.11/barrel, up 66.0 cents from the prior week.

Need Help Making Sense of Natural Gas Prices?

We can help you manage risk and navigate the current price volatility. We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.