.png)

Natural Gas Weekly – October 20, 2022

Natural Gas – Week In Review

Natural gas report week October 20, 2022.

This week’s injection of 111 Bcf was in line with analysts’ expectations which ranged from 96 Bcf to 115 Bcf. Comparatively, last year’s injection was 91 Bcf and the five-year average of net injections is 73 Bcf. Current storage totals 3,342 Bcf which is 5.2% below the five-year average but still within the five-year historical range.

Natural Gas Weekly Fundamentals

Demand

Overall demand grew 9.2%, adding 6.2 Bcf/d week over week. The largest increase in consumption came from heating-related demand which translated to an increase of 5.7 Bcf/d. The LNG export ship count declined by one, totaling 18 for an overall capacity of 67 Bcf.

Production

Production added 0.4 Bcf/d over last week. The natural gas rig count dropped by one, totaling 158 rigs. Oil-directed rigs fell by 2, for a total of 602.

Storage Forecast

The average rate of injections into storage is 5% higher than the five-year average at this point in refill season (which traditionally runs April through October). If the injection rate matches the five-year average of 7.0 Bcf/d through October 31, natural gas supply will total 3,462 Bcf, 183 Bcf lower than the five-year average of 3,645 Bcf.

Natural Gas Prices

Natural gas futures prices fell to their lowest point since March as another triple-digit injection erased more of the storage deficit to the five-year average as the close to injection season approaches. Mild weather forecasts along with an uptick in production subdued prices across the report week. How long that will last will depend on temperatures. Should forecasts shift to a chillier outlook, especially in fall or early winter, it’s reasonable to expect renewed price volatility. Likewise, geopolitical factors and production rates will also be factors to watch.

Natural Gas Weekly Market Report - October 20, 2022

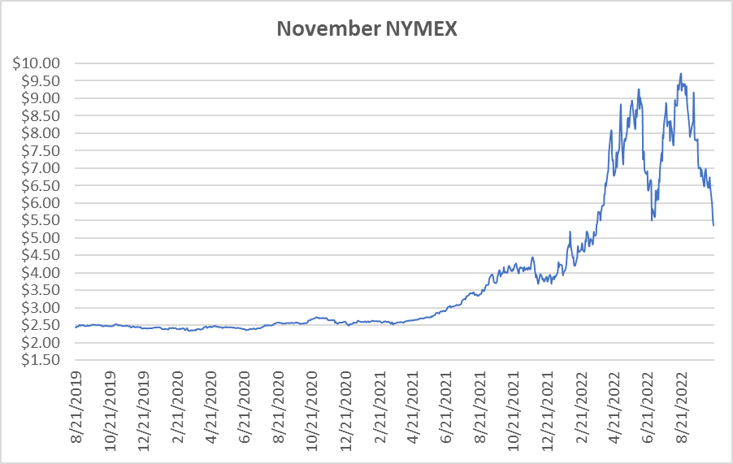

November NYMEX

Settled Thursday at $5.358/Dth up 10.4 cents from Wednesday’s close at $5.462/Dth, but down $1.383/Dth.

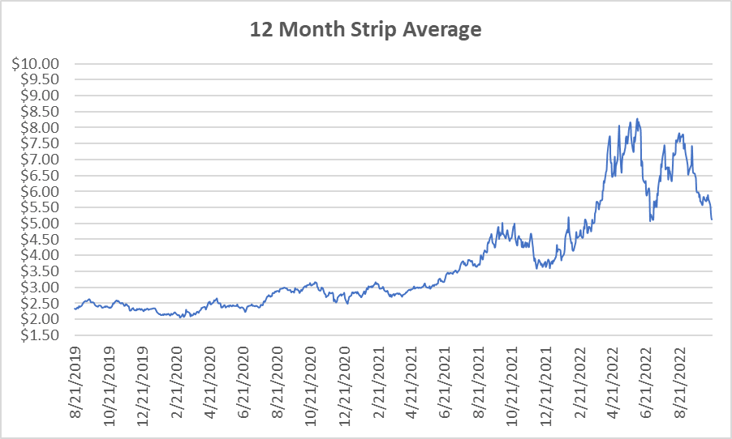

12 Month Strip

Settled Thursday at $5.121/Dth, down 76.7 cents from the prior week.

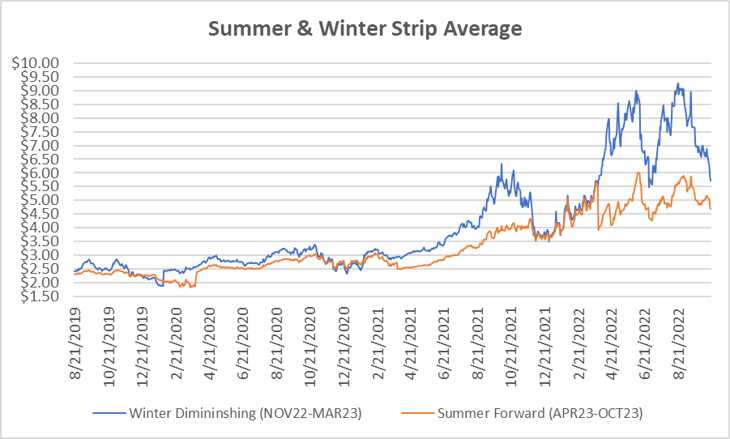

Seasonal Strips

The winter strip (NOV22-MAR23) settled Thursday at $5.722/Dth, down 1.156 cents from last week while the summer strip (APR23-OCT23) settled at $4.692/Dth, down 48.9 cents from last week.

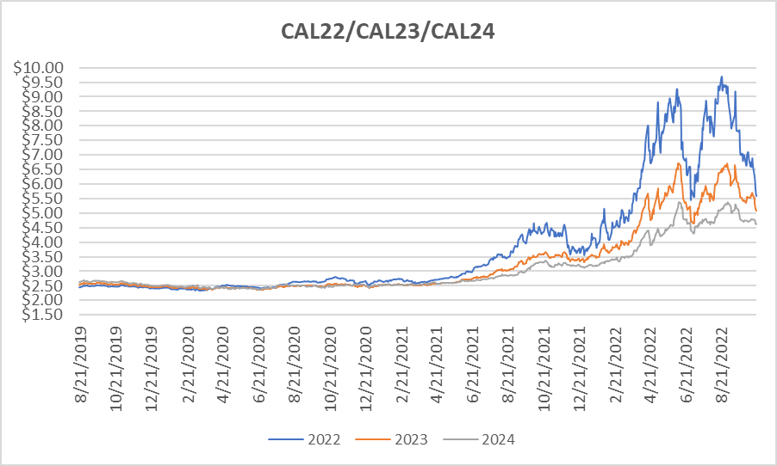

Calendar Years 2022/2023/2024

CY23 settled Thursday at $5.083/Dth, down 61.5 cents from the prior week.

CY24 settled Thursday at $4.610/Dth, down 16.7 cents from the prior week.

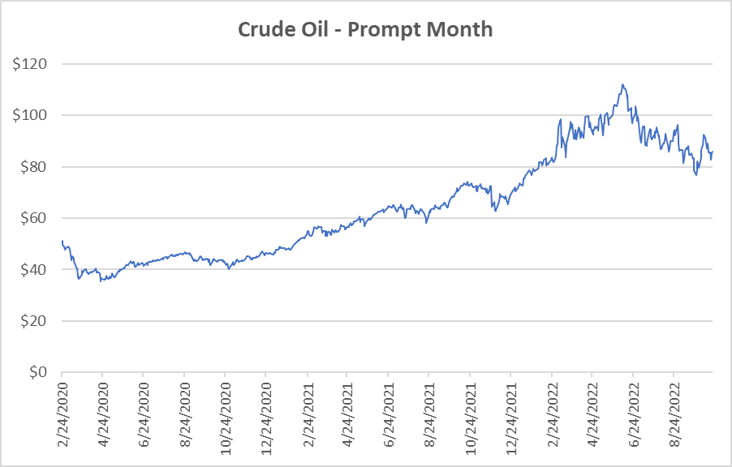

Crude Oil

Settled Thursday at $85.98/barrel, down $3.13 from the prior week.

Need Help Making Sense of Natural Gas Prices?

We can help you manage risk and navigate the current price volatility. We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.