Natural Gas Weekly – June 23, 2022

Natural Gas – Week In Review

Natural gas report week, June 23, 2022.

This week’s injection of 74 Bcf came in above analysts’ expectations which ranged from 56 Bcf - 71 Bcf. Comparatively, last year’s injection was 49 Bcf and the five-year average of net injections is 82 Bcf. Current storage totals 2,169 Bcf which is 13.2% below the five-year average.

For a second consecutive week, domestic natural gas prices fell. This week’s price declines coincided with a storage injection that shot past analysts’ projections, compliments of, in part, subdued LNG exports. As the Freeport LNG facility is expected to remain at least partially offline through the end of the year, what might the additional supply mean for prices?

Let’s take a look…

Natural Gas Weekly Fundamentals

Demand- Total demand up only 0.1 Bcf/d from last week, with LNG pipeline receipts unchanged and total LNG shipments down by three carriers from last week. Since a fire Freeport LNG facility off-lined operations on June 8, departing weekly export ships fell from 22 to 18, shedding 14 Bcf in LNG capacity.

Production – Production remained unchanged week-over-week at 95.5 Bcf/d, up 2.8 Bcf/d over last year. Overall supply declined marginally as imports from Canada fell 0.4 Bcf/d.

Storage Forecast – The average rate of injections into storage is 6% lower than the five-year average at this point in refill season (which traditionally runs April through October). If the injection rate matches the five-year average of 8.4 Bcf/d through October 31, natural gas supply will total 3,314 Bcf, 331 Bcf lower than the five-year average of 3,645 Bcf.

Natural Gas Price Outlook

Help On The Way?

Natural gas prices were well on their way past $9 when the Freeport fire hampered LNG export capacity, amounting to additional volumes for domestic supply. Whether or not the current price trend will continue is anyone’s guess. (After all, who would have foreseen the event at Freeport and the subsequent impact on the natural gas market?)

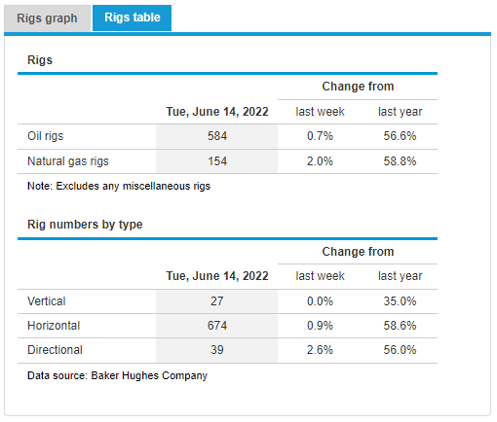

This drove speculation among market analysts. Would the lower prices disincentivize new capital investments and therefore new projects?

While it may be too soon to tell, this week’s EIA Natural Gas Weekly Update may give us a hint “…the natural gas rig count increased by 3 rigs from a week ago to 154 rigs. The number of oil-directed rigs increased by 4 rigs to 584 rigs. The total rig count now stands at 740, the highest level since March 20, 2020, and 270 rigs more than the same week last year.”

Even if it’s a little early to understand how this may specifically impact prices, it remains worth watching.

Natural Gas Market Report – June 23, 2022

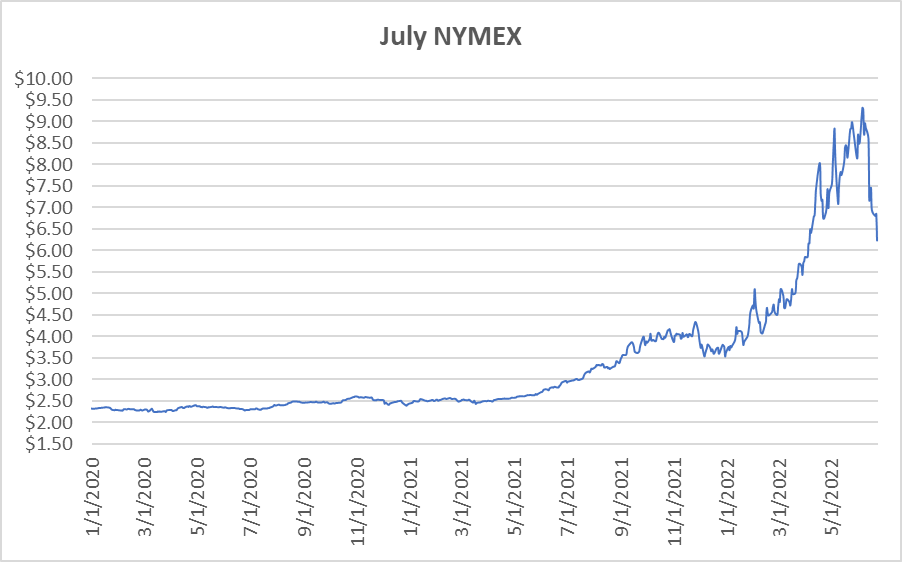

July NYMEX

July settled Thursday at $6.239/Dth, down 61.9 cents from Wednesday’s close at $6.858/Dth. Also down $1.225/Dth over the prior week.

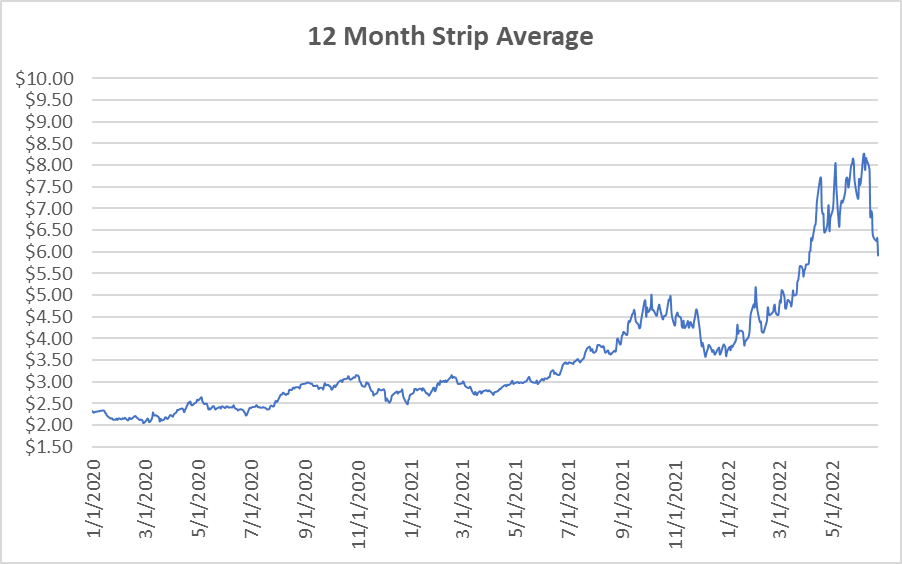

12 Month Strip

Settled Thursday at $5.923/Dth, down 97.4 cents from the prior week.

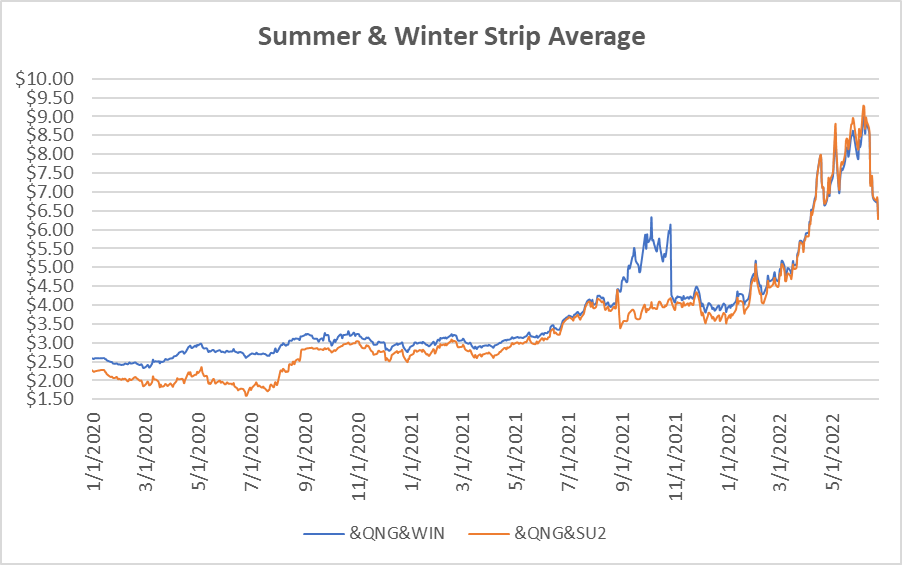

Seasonal Strips

The summer strip (JUL22-OCT22) settled at $6.273/Dth, down $1.147 from the week prior. The winter forward (NOV22-MAR23) settled Thursday at $6.335/Dth, down $1.053 from the week prior.

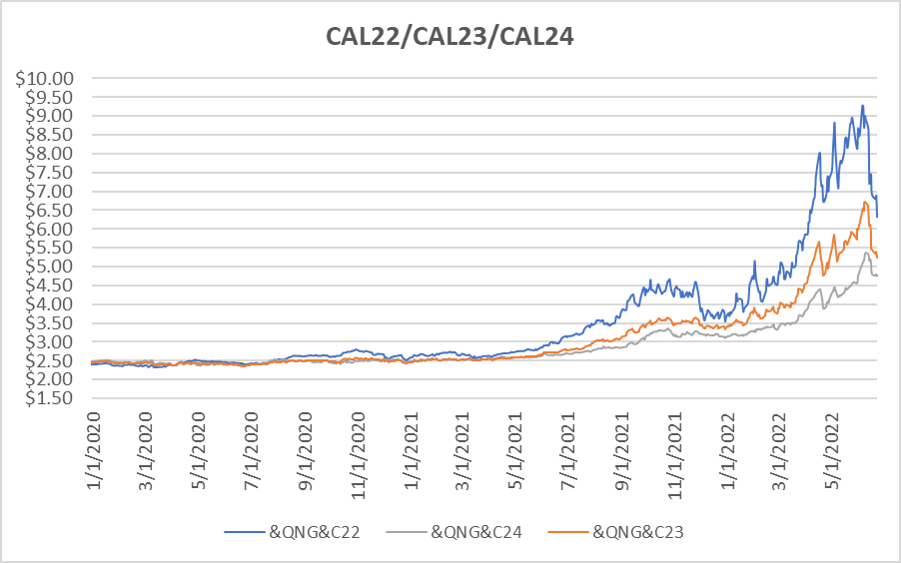

Calendar Years 2022/2023/2024

CY22 settled Thursday at $6.326/Dth, down $1.129 from the prior week.

CY23 settled Thursday at $5.242/Dth, down 69.7 cents from the prior week.

CY24 settled Thursday at $4.748/Dth, down 33.7 cents from the prior week.

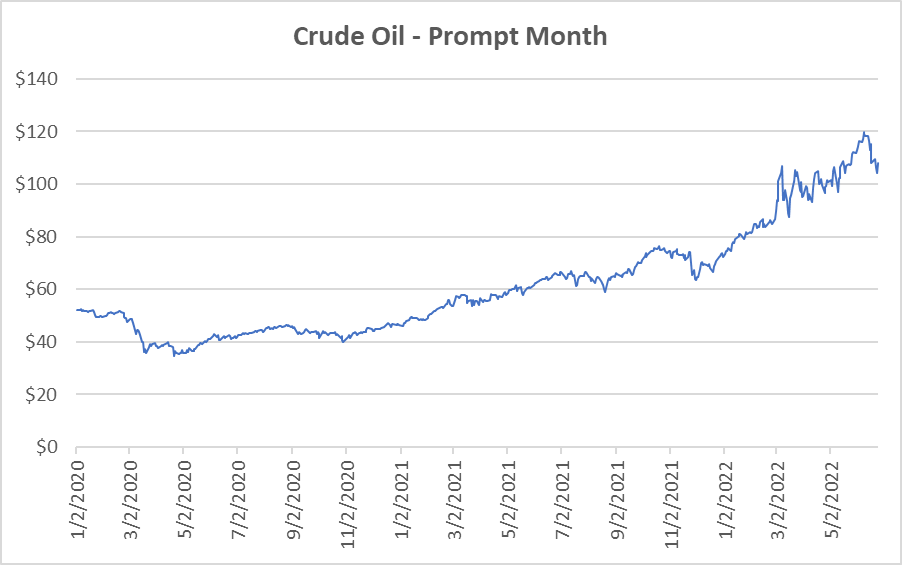

Crude Oil

Settled Thursday at $104.27/barrel, down $10.98 from the prior week.

Need Help Making Sense of Natural Gas Prices?

Give us a call. We can help you manage risk and navigate the current price volatility.

We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.