.png)

Natural Gas Weekly – September 22, 2022

Natural Gas – Week In Review

Natural gas report week September 22, 2022.

This week’s injection of 103 Bcf was at the high end of analysts’ expectations which ranged from 90 Bcf to 104 Bcf. Comparatively, last year’s injection was 77 Bcf and the five-year average of net injections is 81 Bcf. Current storage totals 2,874 Bcf which is 10.4% below the five-year average but still within the five-year historical range.

Natural Gas Weekly Fundamentals

Demand

Total demand declined for a third week, losing 0.7 Bcf/d from last week with lower industrial and power generation related consumption. The LNG export ship count increased by one over the prior week, totaling 21 for an overall capacity of 79 Bcf.

Production

Production declined slightly for the second consecutive week, losing 0.6 Bcf/d. The natural gas rig count dropped by four, totaling 162 rigs. Oil-directed rigs grew by 8, for a total of 599.

Storage Forecast

The average rate of injections into storage is 3% lower than the five-year average at this point in refill season (which traditionally runs April through October). If the injection rate matches the five-year average of 9.7 Bcf/d through October 31, natural gas supply will total 3,313 Bcf, 332 Bcf lower than the five-year average of 3,645 Bcf.

What's Driving Natural Gas Prices This Week?

Price Respite, Thanks to Fundamentals, Time

With more of injection season behind us than in front of us (less than six weeks!) attention has focused on natural gas storage levels, both at home and in Europe. At the beginning of injection season (April), the outlook was less than optimistic with concern growing over what was then considered an anemic storage forecast for many European Union nations. Prices reflected it, with international markets reaching historic highs. Now, with the start to heating season a week away, each of the EU nations have met a goal to have available natural gas storage filled to at least 80%. With worry subdued, European markets have calmed as well.

At home, domestic storage levels trended downward throughout the summer, dancing near the “below-the-five-year-average” mark. Yet this week, late into injection season, a triple digit build that exceeded both last year’s injection as well as the five-year average sent prices tumbling.

It’s interesting that this week the EIA projected that injection season will close with storage 332 Bcf below the five-year average. On June 9th, the EIA projection put storage 340 Bcf below the five-year average as of October 31st. That same week, natural gas prices hit a 13-year high. While superficially inconsistent, the lesson here is that storage deficiencies early in injection season can translate to more upward price support than later in injection season when production/demand/weather fundamentals have less time to significantly impact the outcome.

Natural Gas Weekly Market Report - September 22, 2022

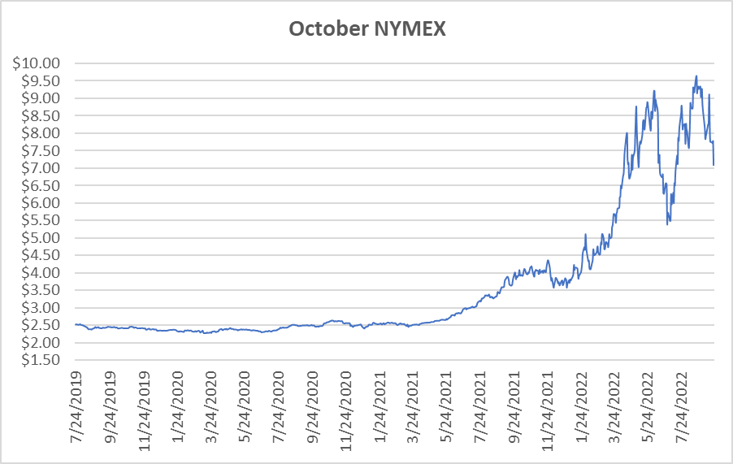

October NYMEX

Settled Thursday at $7.089/Dth, down 69.0 cents from Wednesday’s close at $7.779/Dth, and down $1.235 over the prior week.

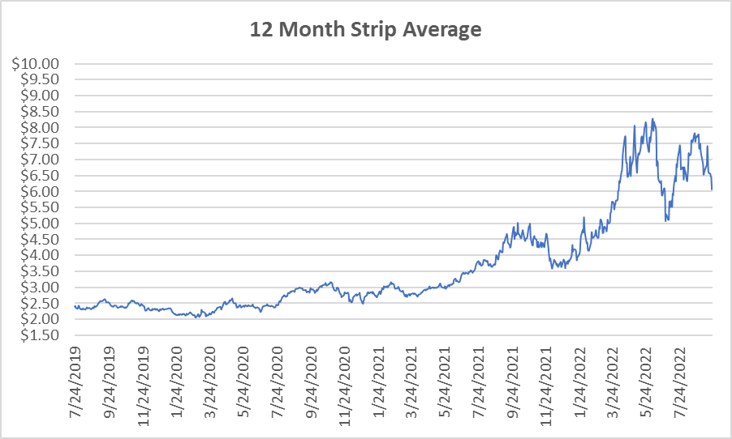

12 Month Strip

Settled Thursday at $6.063/Dth, down 92.3 cents from the prior week.

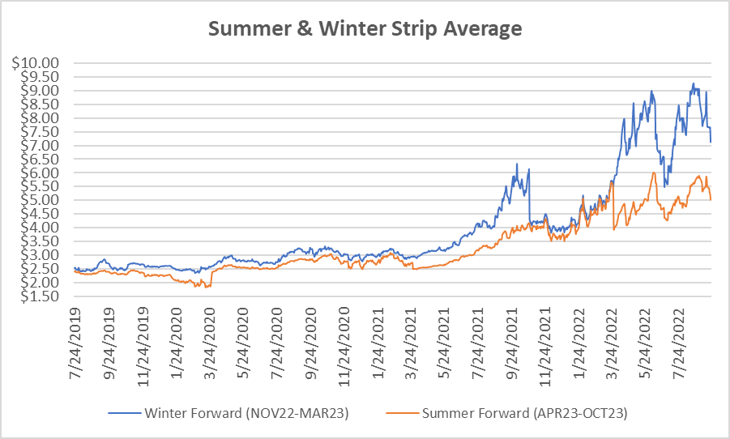

Seasonal Strips

The winter forward (NOV22-MAR23) settled Thursday at $7.120/Dth, down $1.103 from last week while the summer strip (APR23-OCT23) settled at $5.024/Dth, down 71.9 cents from last week.

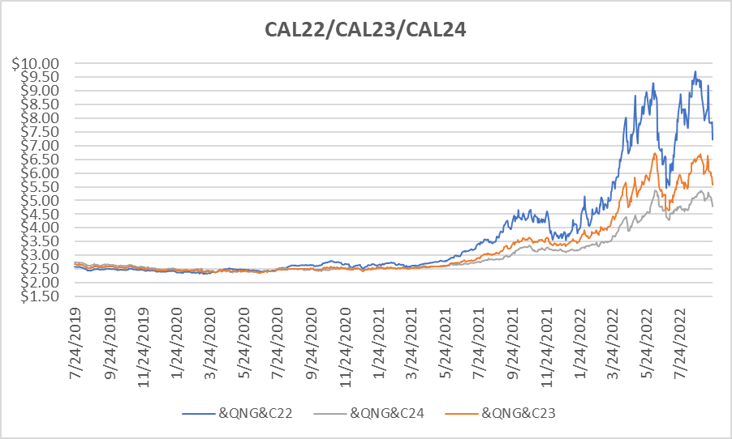

Calendar Years 2022/2023/2024

CY22 settled Thursday at $7.220/Dth, down $1.186 from the prior week.

CY23 settled Thursday at $5.590/Dth, down 79.6 cents from the prior week.

CY24 settled Thursday at $4.785/Dth, down 44.9 cents from the prior week.

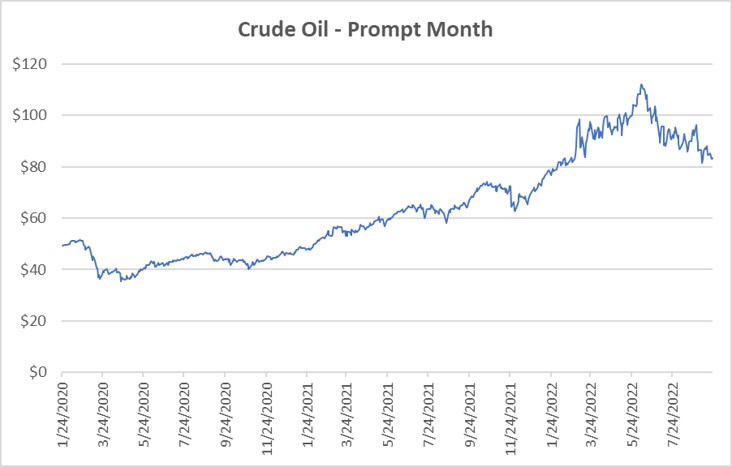

Crude Oil

Settled Thursday at $83.49/barrel, down $1.160 from the prior week.

Need Help Making Sense of Natural Gas Prices?

We can help you manage risk and navigate the current price volatility. We’ll evaluate your current contract and explore your natural gas buying options.

Call us at 866-646-7322 for a no-cost, no-obligation analysis today.